Firms under financial stress may file for bankruptcy protection in order to ease their payment burdens while continuing to trade. The bankruptcy protection provisions of the Enforcement and Bankruptcy Law aim to extend or reduce debts of a debtor, or save them from a possible bankruptcy. This blog post analyzes recent requests to make use of these provisions in relation to financial conditions.

Firms’ indebtedness, debt service capacities and liquidity conditions are key factors in bankruptcy protection processes. This blog post compares various financial indicators of legal entities that filed for bankruptcy protection in 2024 and were granted a temporary respite, with those of other firms[1],[2]. The overall indebtedness levels of firms seeking bankruptcy protection seem to be higher and their liquidity levels seem to be significantly lower than other firms (Chart 1). The ratio of these firms’ trade debt to total assets is 36%, as opposed to 11% for other firms. Likewise, the median ratio of these firms’ vault cash and bank accounts, which are called liquid assets, to short-term liabilities is approximately 2%, while this ratio is around 8% for other firms.

The fact that firms filing for bankruptcy protection were already in high indebtedness and low liquidity levels draws attention to these firms in periods with tight financial conditions. Firms facing liquidity shocks are known to be more likely to default on commercial loans, particularly when exposed to unexpected shocks and approaching the limits of their borrowing capacity. We analyze various risk indicators for firms in 2023 that file for bankruptcy protection in 2024 in order to determine how close these firms were to default prior to filing for bankruptcy protection (Chart 2). The findings suggest that the firms that have recently filed for bankruptcy protection already had a number of pre-monetary tightening financial issues. When the monetary tightening started in June 2023, 41% of the firms that file protection in 2024 were in default, 61% were highly indebted, and 26% had low liquidity levels[3].

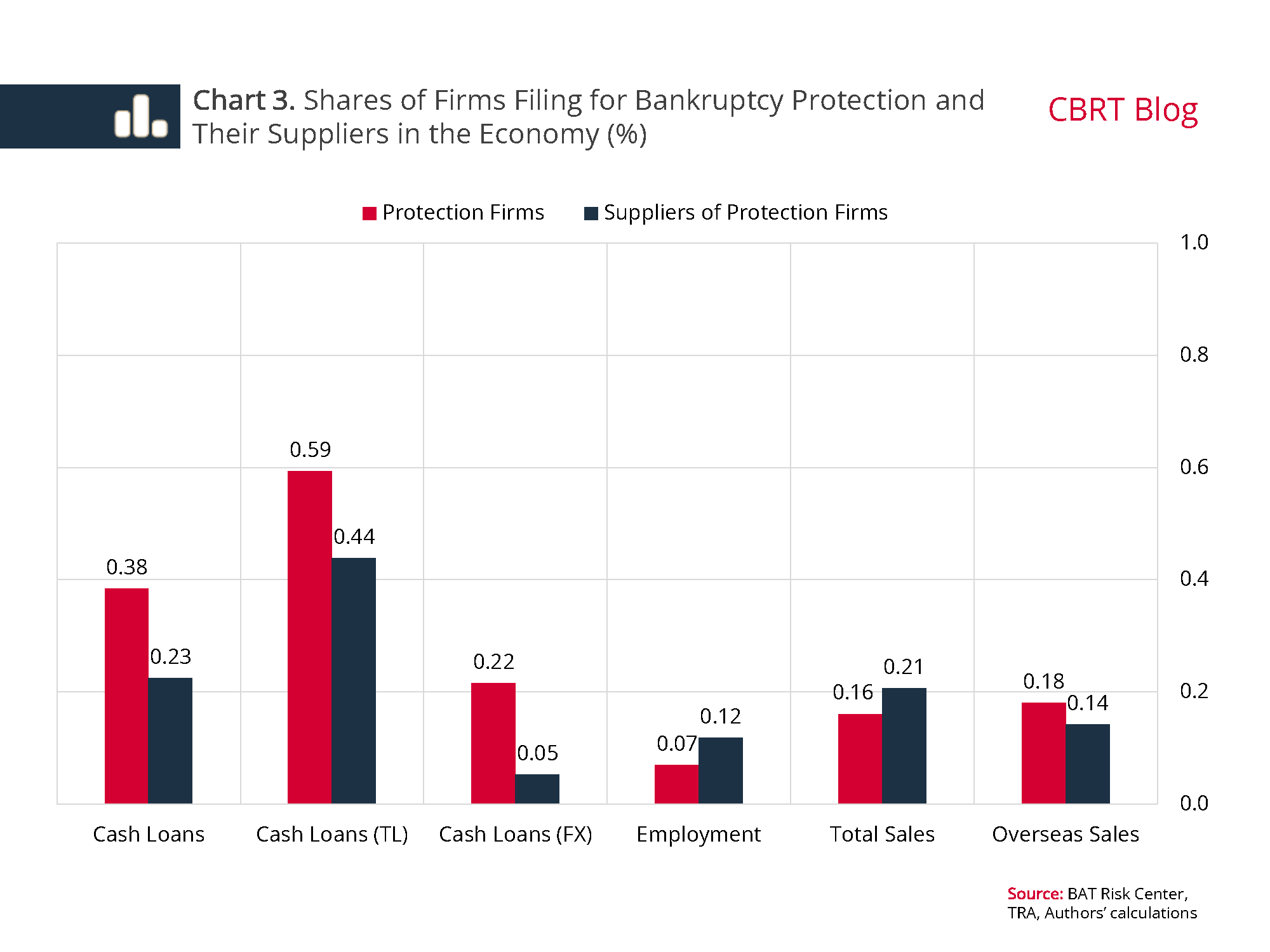

Since the bankruptcy protection process enables firms to delay their payments to their suppliers, the direct and indirect shares of these firms in economic aggregates gain significance. The CBRT closely monitors the developments in corporate sector defaults with regard to economic activity, financial stability, and the continuity of the supply chain. Accordingly, firms that have filed for bankruptcy protection and were given a temporary respite in 2024 account for 0.38% of the total cash balance of commercial loans, 0.07% of total employment, 0.16% of total sales, and 0.18% of total overseas sales. Suppliers of the firms filing for bankruptcy protection account for 0.23% of the total cash balance of commercial loans, 0.12% of total employment, 0.21% of total sales, and 0.14% of total overseas sales (Chart 3).

Lastly, an important consequence of the bankruptcy protection process is its impact on trade between firms. The number of firms’ customers and suppliers appears to decline before filings and remain flat afterwards (Chart 4)[4]. The fall in the number of suppliers before bankruptcy protection filing shows that the problems in cash flow and debt management are also felt by other firms. This indicates that the trade relations of struggling firms weaken before the filing but that firms can continue their operations after filing as stipulated by the relevant law.

In sum, filings for bankruptcy protection by firms under financial stress that operate with high debt and low liquidity may increase cyclically. It is seen that the filings for bankruptcy protection in 2024 are concentrated on firms with a relatively low significance in the economy that were potentially categorized as risky even before the monetary tightening.

[1] When filing for bankruptcy protection, if the necessary documentation is submitted to the court in full, the court immediately grants a temporary respite. The purpose of the temporary respite is to protect the assets of the debtor during the period until the examination, evaluation and hearing are held for a conclusive respite.

[2] The analysis involves legal entities who are corporate taxpayers with matching balance sheet and income statement data. Firms that file for bankruptcy protection have been compiled by taking into account the Banks Association of Türkiye (BAT) Risk Center records.

[3] A firm's default refers to cases where the firm has any non-performing loan debt, accrued or unpaid interest charge, bad check, or protested bill.

[4] The horizontal axis represents the number of months before and after the relevant month when the firm filing for bankruptcy protection (month 0). The average of the numbers of firms’ suppliers and customers in the relevant month is used.