Gold, which is a saving and investment instrument, is kept as physical gold and as gold-backed financial instruments in Turkey. According to the World Gold Council’s estimates, the amount of gold kept under the mattress in Turkey is 3,500 tons[1], and according to the CBRT’s calculation it is 2,200[2] tons. Bringing out this gold and incorporating it into the financial system would make a significant contribution to domestic savings and growth finance.

This gold stock kept under the mattress that will be integrated into the financial system via gold banking will help record the size of household savings and increase savings overall. The banks will be able to use the gold incorporated into the system as a funding source and thus economic activity will be underpinned through the credit channel. The legal framework of gold banking is governed by the Communiqué No: 2008-21/35 regarding Decree No. 32 on the Protection of the Value of Turkish Currency and the Banking Regulation and Supervision Agency (BRSA)’s “Regulation on the Procedures and Principles for Sales and Purchase of Precious Metals by Banks”.

The gold banking activities, the legal framework of which is governed by these legal arrangements, mainly cover current gold account and time gold account services provided to depositors in the scope of precious metal deposit accounts. These deposits can be opened either by delivering physical gold or against cash. In addition to these accounts, gold is accepted as a type of foreign currency and several alternative investment products are available for gold such as floating rate deposit accounts, gold-backed investment funds and gold certificates and bonds presented to depositors.

In the financial system, there are other gold-related investment products such as gold swap, gold credit and the Gold Exchange Traded Fund (ETF). Banks can buy/sell from/to their customers pure gold bullion with 995/1000 fineness that their contracted refineries produce for them and banks allow their customers to withdraw physical gold from ATMs.

In this framework, we believe that the process of bringing out the gold under the mattress and registering it has started by allowing banks to buy/sell gold in grams and open precious metal deposit accounts.

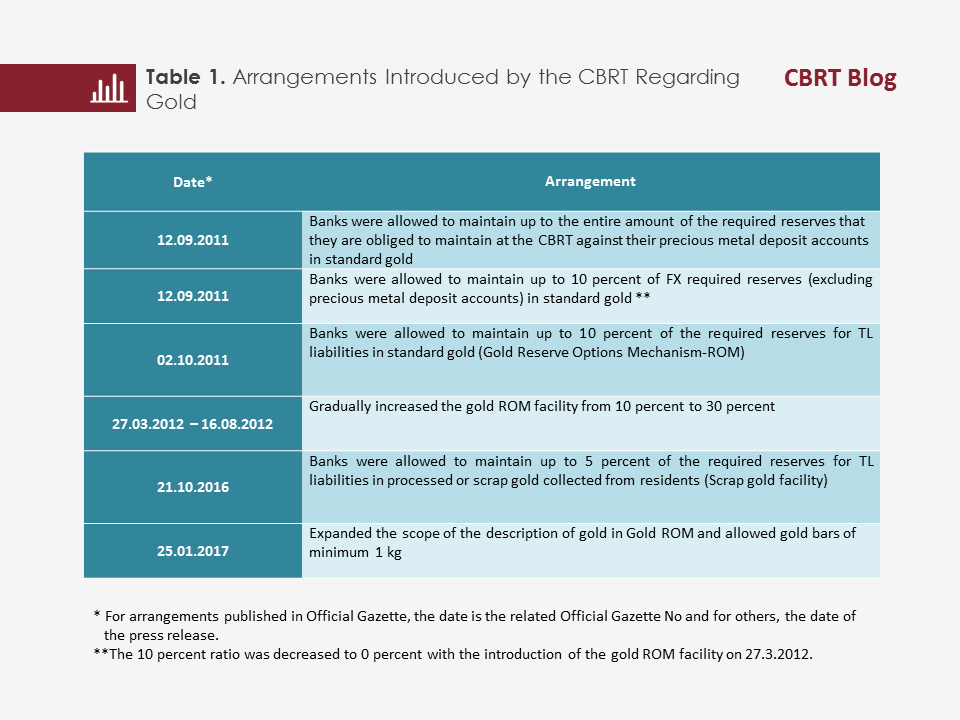

The rapid growth of gold banking over the recent years and the proliferation of gold products and services provided by banks have accelerated registration of gold under the mattress and some part of the success belongs to the Central Bank of Turkey because of the innovative decisions and arrangements that it has introduced. In this framework, since 2011, via its policies allowing banks to maintain required reserves in gold, the CBRT has encouraged registering the gold under the mattress, thus, Turkey’s gold reserves has increased and more flexibility has been provided for banks in liquidity management that positively affected banks’ costs and liquidity channels.

In addition to the arrangements concerning the reserve requirement system shown in the Table above, the CBRT announced that as of 28 July 2017, it would start buying from banks processed gold and standard gold transformed from scrap gold collected from residents and standard gold produced from gold ore in Turkey against Turkish liras. In this way, the reserves would be fortified and a market would be created into which gold savings would be registered.

Despite all these developments, it is observed that Turkish investors, who make part of their investments in gold, prefer to keep their gold investments in physical gold, that their demand for gold-backed financial system instruments has not yet reached the desired level, and investors still keep their gold out of the financial system[3]. Therefore, developing and proliferating financial instruments to draw out the gold kept under the mattress will be very important in the upcoming period.

In this framework, the gold bonds and gold-backed lease certificates introduced by the Treasury are an important step towards attracting the gold kept under the mattress. The first issue of the gold-backed debt securities was welcomed by gold investors and 2.5 tons of gold were brought out and attracted into the financial system[4]. These bonds will contribute to the securitization of an idle resource and incorporating these resources into the economy will decrease the funding need of the system.

To conclude, integrating gold banking instruments into the financial system is important for the Turkish economy. In this regard, the CBRT and several other institutions have taken significant steps supporting gold banking. Currently, all stakeholders led by commercial banks are expected to contribute to developing and proliferating gold-related financial instruments to ensure the success of the process.

[1] http://www.gold.org/supply-and-demand/turkey-gold-in-action

[2] CBRT, Inflation Report

[3] Tağtekin, Özlem (2016), Türkiye’nin Altın Piyasasındaki Konumu ve Türk Altın Yatırımcısının Davranışına İlişkin Bir Araştırma 2016, T.C. İstanbul Ticaret Üniversitesi, İstanbul (A Research on Turkey’s Role in Gold Market and Behavior of the Turkish Gold Investor 2016- available only in Turkish)

[4] Source: Domestic borrowing statistics of the Undersecretariat of Treasury

Bibliography:

http://www.gold.org/supply-and-demand/turkey-gold-in-action

CBRT, Inflation Report 2012-IV

Tağtekin, Özlem (2016), Türkiye’nin Altın Piyasasındaki Konumu ve Türk Altın Yatırımcısının Davranışına İlişkin Bir Araştırma (A Research on Turkey’s Role in Gold Market and Behavior of the Turkish Gold Investor 2016- available only in Turkish) 2016, T.C. İstanbul Ticaret Üniversitesi, İstanbul

Domestic Borrowing Statistics of the Undersecretariat of Treasury