The ability of employees to smoothly transition into different jobs and sectors is essential for the efficient functioning of the labor market. Flexibility of job transitions enables rapid alignment of labor supply and demand under changing conditions. In this blog post, we examine the changes in Türkiye’s labor market over the one-year period ending in May 2025, with a special focus on employment and job transitions by sectors.

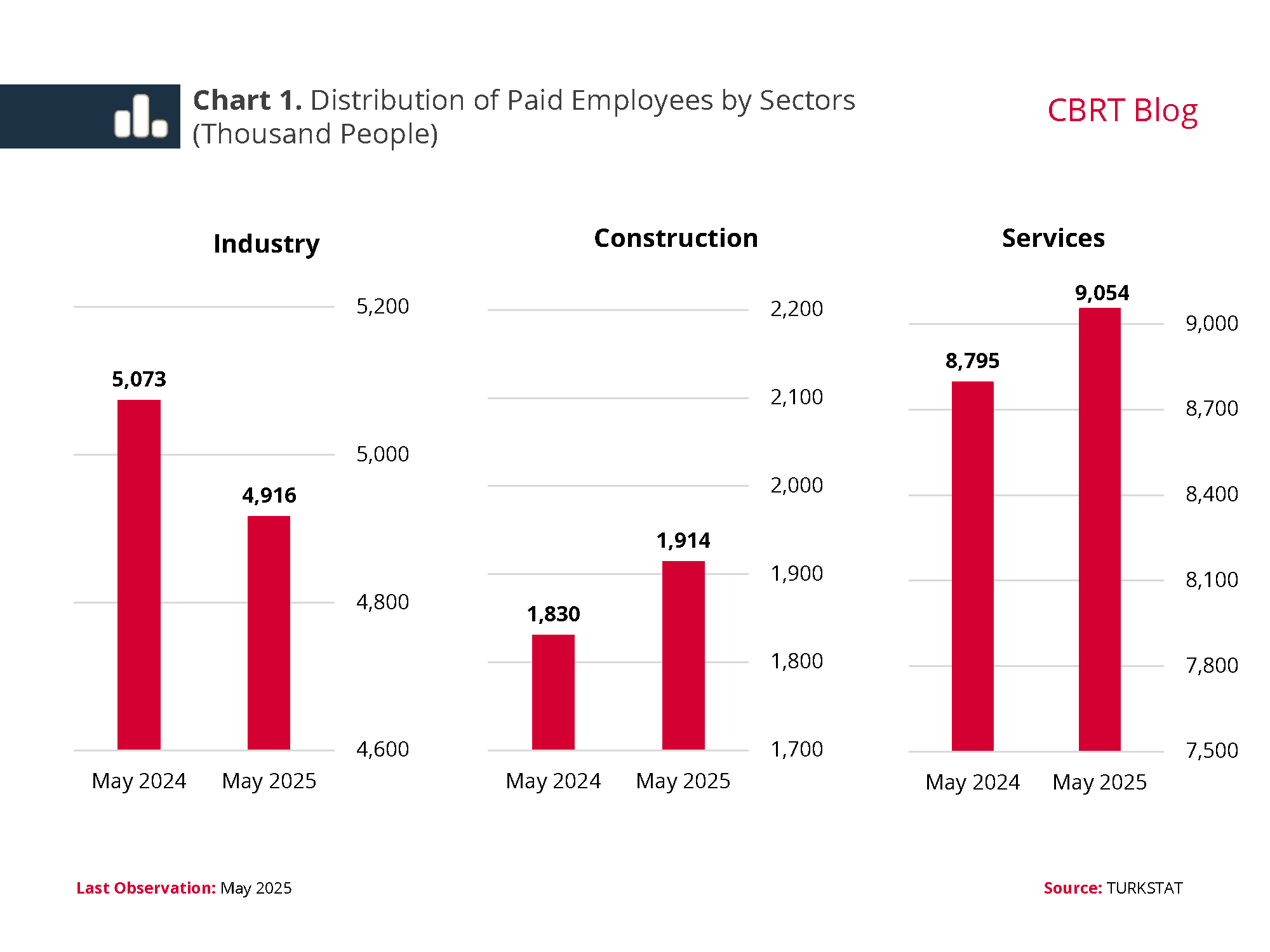

According to TURKSTAT’s paid employee statistics, total employment increased by 1.2% between May 2024 and May 2025, while the sectoral distribution of employment changed in this period. Employment in the industrial sector declined by approximately 157 thousand people (3.1%) in this period, whereas employment rose by 83 thousand people (4.6%) in the construction sector and 258 thousand people (2.9%) in the services sector (Chart 1).

The sectoral distribution of employment reveals that the share of the industrial sector is gradually decreasing, while that of the services sector is increasing. This change is indeed consistent with long-term global trends. As countries advance economically, the share of the industrial sector in employment typically declines—even if the sector’s production volume remains stable or increases. This is attributable to factors such as productivity gains driven by technological advancements, changes in consumer preferences favoring services, and the relocation of manufacturing processes to other countries due to global competition. As a result, the employment share of the services sector increases. Related data suggest that the share of services in employment is much higher in high-income countries than in Türkiye (Chart 2). Similarly, in Türkiye, the industrial sector’s share in total employment is approximately 5 percentage points higher than the averages observed in both high-income countries and the OECD overall. With further economic development, the services sector’s employment share in Türkiye can be expected to increase gradually, bringing its employment distribution closer to that of high-income countries.

To analyze changes in the sectoral composition of employment and the labor market implications of the employment losses in the industrial sector, we track employees for a period of one year using administrative records from the Social Security Institution (SSI), matched at the employee-firm level under the 4A-employment coverage.[1] Chart 3 shows the labor market status of employees who were employed in May 2024 but were no longer registered as employed in June, tracked over the 12 months following their job exit. Of the approximately 835 thousand individuals who left their jobs, 191 thousand (23%) found another job as early as July, with the total number reemployed within one year reaching about 563 thousand (67%).[2] As the people who were not reemployed during this period also include public servants (covered by the SSI’s 4C classification), self-employed entrepreneurs (covered by the SSI’s 4B classification), and retirees, we cannot conclude that all of the remaining 33% are unemployed.

We conduct a similar analysis for the manufacturing industry, which accounts for the major share of industrial sector employment.[3] Among the 172 thousand employees who were working in manufacturing in May 2024 but were not registered as employed in June, 117 thousand (68%) got a new job by May 2025 (Chart 4). This reemployment rate is broadly in line with the overall average, indicating that job losses in the manufacturing industry are less likely to exert an additional upward pressure on the overall unemployment rate in the future, compared to other sectors.

Additionally, to examine the flexibility to switch between sectors, we analyzed the sectors in which 117 thousand individuals who left their jobs in the manufacturing industry were reemployed. Based on May 2025 data, 47 thousand of them started to work in their own sector again. Among the remaining 70 thousand who changed sectors, 49% (34 thousand) transitioned to the services sector, 34% (23 thousand) switched to different subsectors within manufacturing, and 15% (10 thousand) moved to the construction sector (Chart 5).

Lastly, we conduct a year-by-year comparison of reemployment rates within one year of job separation (Chart 6). At 67%, the reemployment rate for employees who were working in May 2024 but not registered as employed in June is generally above the rates in previous years. For instance, this rate was 63% in May 2018. Excluding 2020—when the labor market posted a rapid recovery following the pandemic (May 2020-May 2021)—2024 marks the highest reemployment rate within one year.

To sum up, based on the latest data, the share of the industrial sector in employment has decreased in 2025, whereas the services sector’s share has increased. We expect that this shift to continue on the back of sustained economic development over the medium and long term, leading Türkiye’s employment distribution to converge with that of high-income countries. On the other hand, we see that Türkiye’s labor market has been dynamic recently, with a large portion of workers who left their previous jobs successfully finding a new employment. This holds true both for the overall labor market and for employees in the manufacturing industry.

[1] Trainees and apprentices are not included in the analyses.

[2] When the same calculation is repeated for employees, who were employed in December 2023 but were not registered as employed in January 2024, this ratio stands at 68%. Thus, there was no significant change in labor market flexibility over the last six-month period.

[3] The industrial sector covers the mining, manufacturing, production and distribution of electricity, gas, and air-conditioning, and water supply; sewerage, waste management and remediation activities subsectors. Manufacturing industry employment makes up 93% of total industrial sector employment. The manufacturing sector also accounted for approximately 155 thousand of the 157 thousand decline in the number of employees in the industrial sector between May 2024 and May 2025.