A developed and efficient government domestic debt securities (GDDS) market attracts foreign investors to Turkey. Actually, while GDDS held by non-residents has increased over time, the GDDS portfolio of non-residents has become an important item within the financial account of the balance of payments. This study analyzes the profile of non-residents investing in Turkish GDDSs.

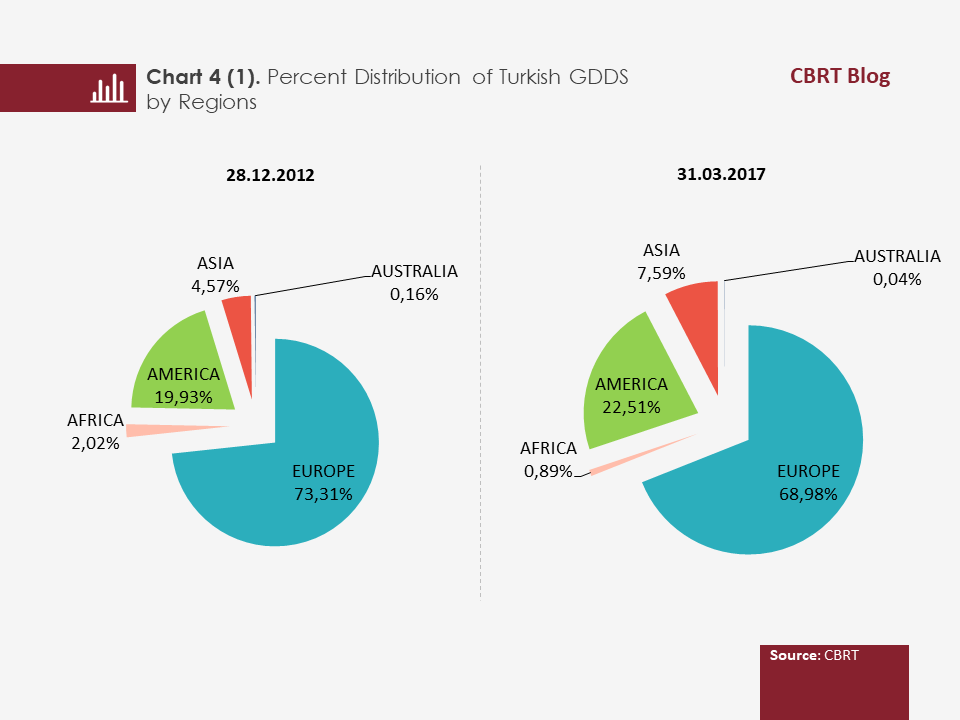

By 2017Q1, non-residents held USD 26.3 billion of GDDS, corresponding to 19 percent of the total GDDS stock. This ratio, which reached a peak in 2013 with 29 percent, has since decreased and has been hovering around 20 percent recently (Chart 1).

An analysis of the maturity structure of non-residents’ Turkish GDSS stock reveals that generally, foreigners tend to invest in securities with longer maturities. The shift in non-residents’ demand for Turkish long-term securities has been increasing since 2012 when Turkey’s credit rating was upgraded to investment grade. In 2017Q2, 83 percent of foreigners’ GDDS stock was composed of securities with maturities longer than 2 years (Chart 2).

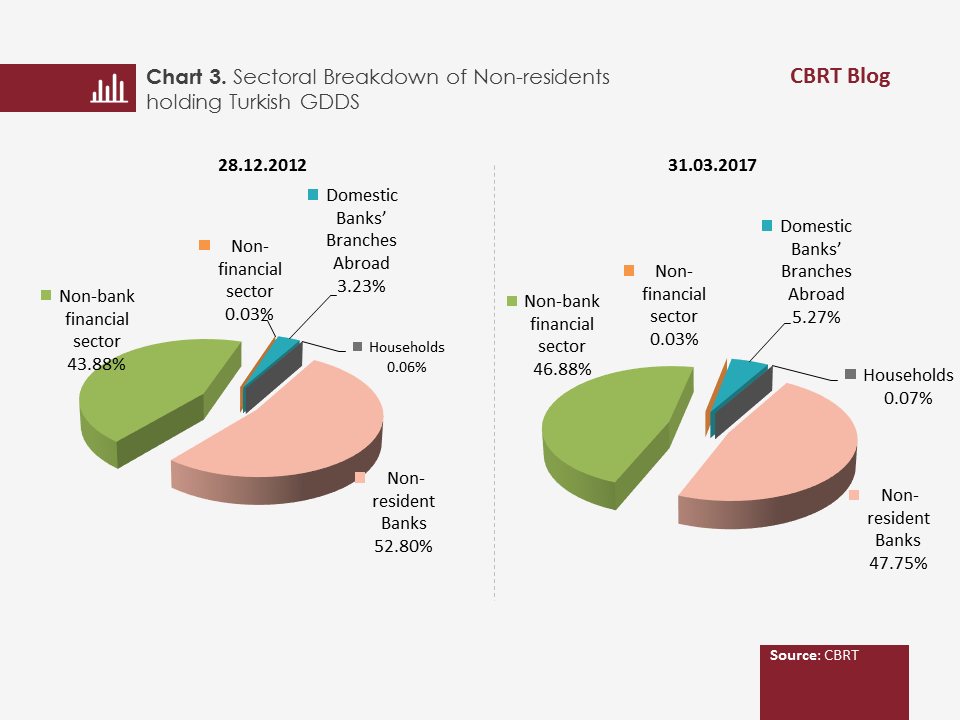

A sectoral breakdown of non-residents holding Turkish GDDS reveals that they are mostly institutional investors. Accordingly, foreign banks and the non-bank financial sector rank in first and second place with shares of 48 and 47 percent, respectively. Domestic banks’ branches abroad, which are regarded as foreign banks as per the balance of payments methodology, have a 5 percent share. The shares of non-resident real persons and real sector firms holding Turkish GDDS are at negligible levels. Meanwhile, compared to 2012, the share of the non-resident non-bank financial sector has slightly increased and converged to that of foreign banks (Chart 3).

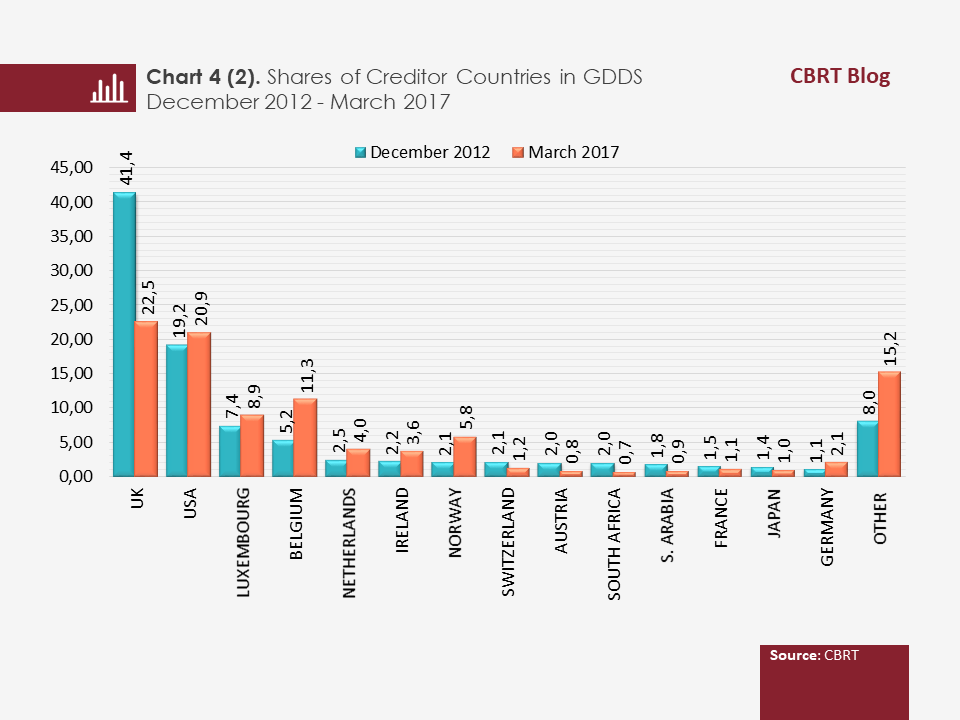

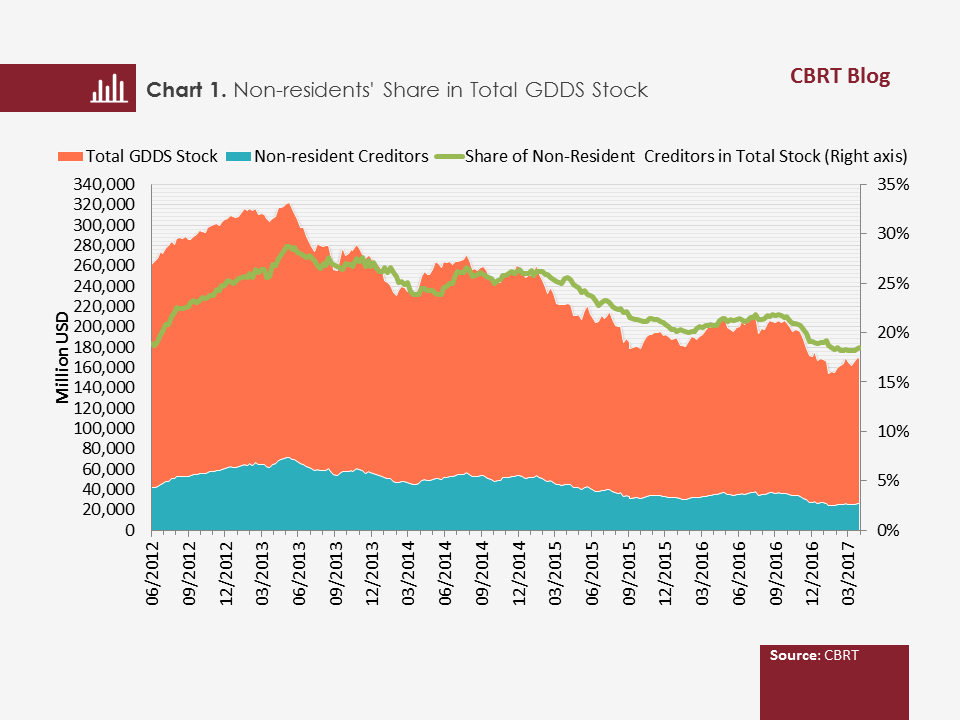

The regional breakdown of non-residents holding Turkish GDDS reveals that Europe leads the list. While the European region’s share in Turkish GDDS stock held by non-residents was 69 percent as of 2017 Q1, continental America’s share was 23 percent. A breakdown of the GDDS stock by creditor country shows that the UK, the USA and Belgium have the largest shares. Moreover, compared to 2012, it can be asserted that country distribution has widened (Chart 4).