The Turkish economy has been undergoing a rebalancing process in terms of growth composition since the third quarter of 2023. Meanwhile, the recent relatively weak course of global growth has had an impact on export performance both globally and in Türkiye. In this blog post, we analyze Türkiye’s exports to the European Union (EU), our main trading partner, and summarize our findings on the determinants of exports.

From 2002 to 2007, Türkiye's real exports to the EU exhibited a gradual and consistent increase (Chart 1). However, the global financial crisis of 2008 led to a significant decline in exports. As the effects of the crisis waned, Türkiye's exports to the EU recovered and followed a stable growth trajectory between 2010 and 2019. More recently, after the sharp decline caused by the Covid-19 pandemic, exports recovered quickly, exceeding the level implied by the pre-pandemic trend. Since the final quarter of 2022, however, exports have been hovering below the level implied by the trend between 2010 and 2019. On the other hand, the recent increase in exports to non-EU countries has prevented a decline in Türkiye's total exports (Chart 2). This may be interpreted as evidence that EU-induced effects also contributed to Türkiye’s weakened export performance to the EU.

Since the third quarter of 2022, when Türkiye’s exports to the EU weakened, there has been a noticeable divergence between the EU’s GDP and the bloc’s goods imports (Chart 3). The ratio of goods imports to GDP of the EU, which exhibited an upward trajectory following the pandemic, has been declining since the final quarter of 2022 and converging to its pre-pandemic levels (Chart 4). In contrast, the ratio of services imports to GDP has continued to increase. Studies on recent import dynamics in the EU indicates that the observed decline in the income elasticity of imports is driven by several factors. These factors include the change in the composition of demand and the decline in inventories. Moreover, the shift in private consumption from goods to services also contributed to the decline in the income elasticity of imports.[1] In this context, we assess that the recent course of Türkiye's exports to the EU may have been affected by post-pandemic changes in the EU economy.

To analyze the factors affecting Türkiye’s real exports to the EU, we first estimate two separate equations that incorporate demand and relative prices, which are the primary drivers of exports. In our equations, we use the developed countries-based real effective exchange rates for the relative price and the EU’s GDP and imports as demand indicators. To evaluate the impact of the pandemic, we have estimated separate models for the periods 2003Q1-2024Q2 and 2003Q1-2019Q4. The estimation results indicate that the EU demand indicator is the main driver of Türkiye's goods exports to the EU (Table 1). Prior research findings also suggest that the EU demand indicator is the main driver of Türkiye's exports to the EU.[2]

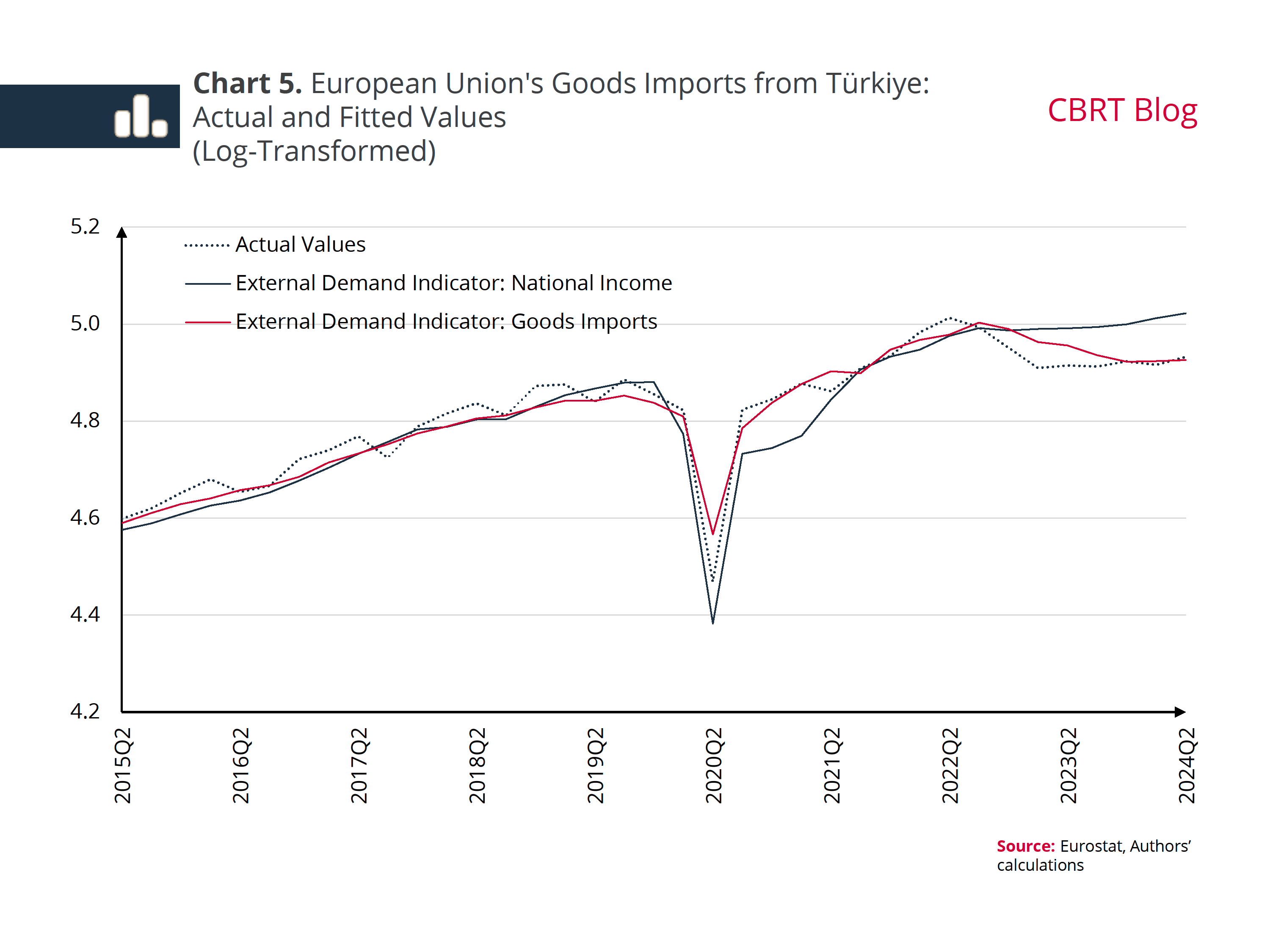

The model estimation in which EU imports of goods are used as a demand indicator (model 2) appears to align more closely with realizations in the recent period, while the model in which GDP is used implies a higher level of imports (Chart 5). In the post-pandemic economic reopening period (2020Q1-2021Q3), the model using GDP as a demand indicator underestimates the import realizations. This indicates that the change in the elasticity of income for the EU’s imports also influenced the trajectory of Türkiye’s exports to the EU in the post-pandemic period.[3]

Despite the decline in the ratio of the EU’s goods imports to national income, Türkiye's share in EU imports has been increasing gradually since January 2023 (Chart 6). In other words, the negative impact of EU market conditions on exports is partially offset by market share gains.

In conclusion, the recent weak course in exports to the EU can be attributed primarily to the fact that EU national income has remained below its pre-pandemic trend and that there has been a reduction in income elasticity of goods imports. On the other hand, based on the forecasts of international institutions and investor organizations, GDP growth in the EU is expected to increase gradually, and also the ratio of EU’s import growth to GDP growth is expected to approach historical averages in the upcoming period. This will underpin Türkiye's exports to the EU, and exports to the EU will continue to increase amid the favorable outlook in market share.

[1] For detailed information on this topic, please see: Lebastard et al., 2024

[2] For further details on this topic, please refer to Inflation Report 2019-II, Box 4.4.

[3] Given the insufficient number of post-pandemic observations, no separate income elasticity estimate could be made for the recent period. As illustrated in Table 1, the decline in the national income elasticity of imports, from 3.72 during the 2003Q1-2019Q4 period to 3.43 during the 2003Q1-2024Q2 period, suggests that the elasticity has recently fallen below 3.43.

References

Lebastard, L., Olivero, L. and Giacomo, P. 2024, Why did the import intensity of GDP slow down in 2023?, ECB Economic Bulletin, Issue 3/2024.

CBRT Inflation Report Volume: 2019-II, Box 4.4