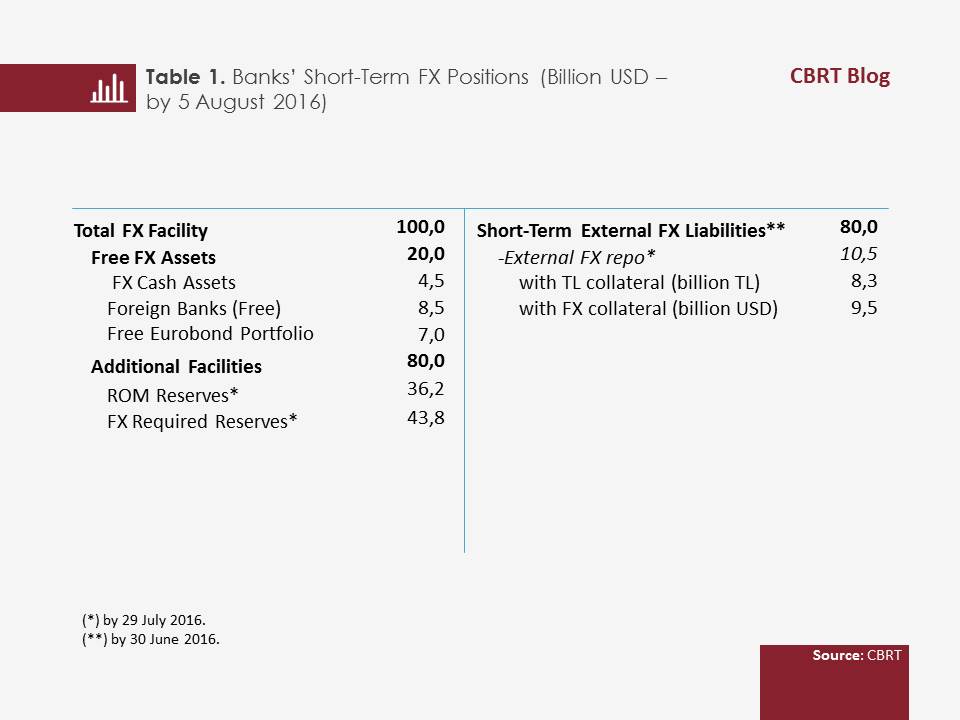

The banking sector’s foreign exchange (FX) denominated external debt to non-resident banks, which will be due in one year, stands at approximately 80 billion USD. Past experiences show that banks are able to roll over more than half of their external debt even in the most unfavorable economic and financial conditions. Our analysis indicates that the Turkish banking system has adequate level of liquidity buffers to cover short-term FX external liabilities even if none of these debts can be rolled over.

Turkish banks have a total of 4.5 billion USD of FX cash assets and their holdings at free accounts of foreign banks amount to a total of 8.5 billion USD. They also have free Eurobond portfolios amounting to a total of 7 billion USD. Accordingly, banks’ total free FX assets correspond to an amount of approximately 20 billion USD.

By the end of July 2016, within the scope of Reserve Options Mechanism (ROM), banks had a total of 36.2 billion USD of FX and gold reserves convertible to TL if needed. The banking system holds an adequate amount of TL liquidity to withdraw almost all the reserves that they have within the scope of the ROM. Given the banks’ ROM reserves, which can be withdrawn by pledging the free TL assets as collateral, in addition to their total free FX assets, the banks can cover more than 70 percent of their short-term FX external debt.

Liquidity facilities that are provided to banks by the CBRT are not limited to ROM reserves. As of the end of July, additionally 44 billion USD worth of required reserves were maintained by the banks against their FX liabilities subject to reserve requirements. The CBRT can release these FX required reserves in the event of possible financial distress. With this additional potential facility, banks have a level of FX liquidity that is sufficient to cover 125 percent of their short-term FX external debts. In other words, banks have a strong FX liquidity shield. Additionally, they have an FX deposit limit of 50 billion USD in total, provided by the CBRT.

On the other hand, approximately 13 percent of the external liabilities due within one year consist of secured repo transactions. The bulk of collaterals is Eurobond. In the case that these repo transactions are not renewed, FX and TL securities of 9.5 billion USD and 8.3 billion TL will be released, respectively. The way is open for banks to provide liquidity by selling them on the secondary market or by pledging them as collateral to use the CBRT’s TL and FX liquidity facilities.

Consequently, the Turkish banking system has an adequate level of liquidity buffers to cover short-term FX external liabilities.