The largest source of funding of the banking sector in Turkey is deposits, accounting for more than 50% of the total funding. 1 Although the share of deposits in funding has declined slightly since 2011 due to the increase of security issues on both domestic and foreign markets, and increased borrowing facilities from foreign financial corporations, deposits remain crucial in terms of their share in total funding and in their role in financial stability.

Maturity of deposits is as important as their share from the perspective of the quality of funding. Withholding rates applied to deposits have been differentiated since 2 January 2013 in order to promote the long term and national currency in accounts opened. Accordingly, while the withholding rate applied to the returns on Turkish lira (TL)-denominated demand deposits and term deposits with a maturity of up to six months was kept at 15%, this rate was reduced to 12% and 10% for deposit accounts with maturities of up to one year and longer than one year, respectively. As per the Presidential Decision of 31 August 2018, with a view to both promoting Turkish lira deposits and contributing to the extension of maturities, the income tax withholding rates to be applied to the interest paid on the deposit accounts either opened or renewed during the three-month period following the date of the Decision were revised as follows (Table 1):

While the new regulation stipulated an increase in withholding rates on the interest earned from foreign exchange (FX) deposit accounts with a maturity of one year or shorter that were opened or renewed during the period between 31 August and 30 November 2018, it imposed a reduction in withholding rates charged on TL accounts. Accordingly, TL deposit accounts that were opened or renewed until 30 November 2018 qualified for the reduced withholding rates on their returns and continue to be subject to the lower rate until their maturities. For instance, as the income tax withholding rate to be applied to a deposit account of TL 1,000 with a maturity of 366 days and an annual interest rate of 25% would be zero percent, this account would yield a net income of TL 250 instead of TL 225. Given that the regulation provides a larger net income for longer maturities and a longer time horizon to benefit from low withholding rates, it is expected to promote long-term TL deposits, primarily those with maturities longer than one year.

The breakdown of TL deposits by maturity during the enforcement period of the regulation points to an increasing share of long-term TL deposits. As of 30 November 2018, the share of TL deposits with maturities longer than one year increased by 93% and that of TL deposits with maturities from six months to one year increased by 99% compared to 31 August 2018. In the same period, while the share of deposits with maturities of one to three months was 58%, the share of those with maturities of three to six months rose by 132% to 7.4%. And the share of TL deposits with longer than six-month maturity increased to 5% from 2.5% in total (Table 2).

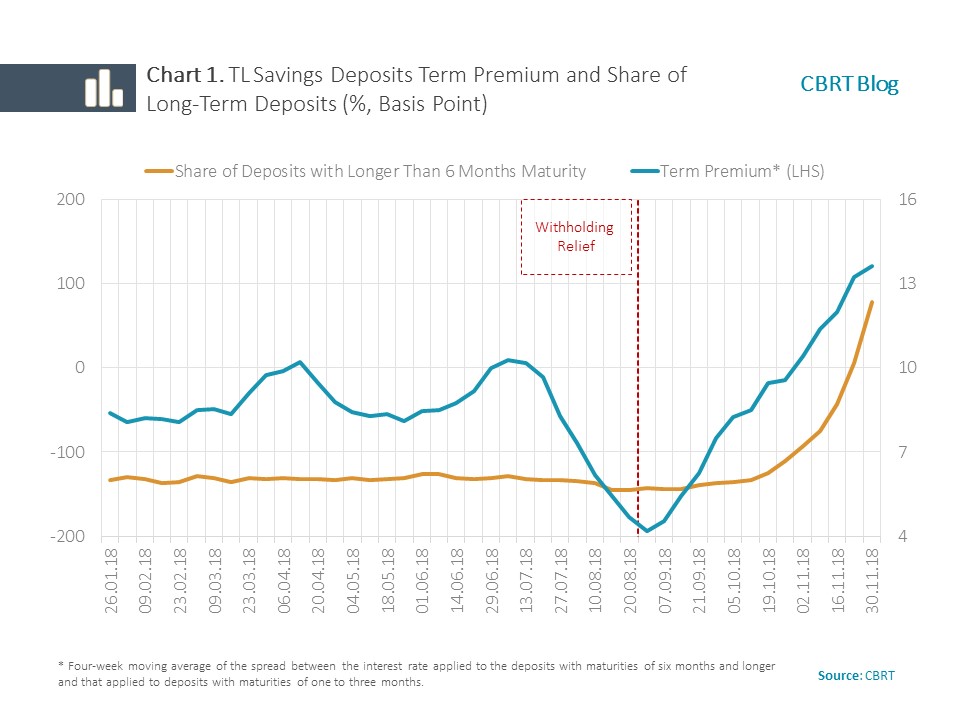

In sum, our observations signal that the withholding regulation has been influential in extension of maturities. However, it should also be noted that the yield curve can also affect maturity preferences for deposits.

Recent developments regarding interest rates on TL savings deposits reveal that in the period following August, the increase in deposit rates was more noticeable for the long term in particular (Table 3).

This relative increase in the long-term gross interest (Chart 1), coupled with expectations that were shaped around a likely decline in interest in the forthcoming periods and the withholding advantage, may have canalized savings towards long-term deposits.

To conclude, we see a noticeable extension in maturities of TL deposits since September. We assess that in addition to the movements in the deposits yield curve, the withholding regulation also had a role in this development. In the current financial setting, which has seen favorable implications of fading uncertainties and a macroeconomic rebalancing, the tax regulation made vis-à-vis withholding rates has contributed to the extension of deposit maturities as well as to curbing the dollarization.

1 In this blog post, deposits refer to those including participation funds and deposits rates refer to those including profit shares.