Recently, the volatility in supply of food and food prices has been making it more difficult to design policies at the macro level, especially in developing countries. This volatility occupies a place on every policymaker’s agenda due to the widespread impact of the food sector on the general economy. The group that is most severely affected by this volatility is the low-income household group spending a significant ratio of their income on food; and when all the sectors that have a reciprocal relationship with the food sector are taken into account, it is more easily observed how large the impact horizon of the volatility in this sector is. That’s why taking measures that will make a favorable impact on the level and volatility of food prices is one of the issues that policy makers have been discussing recently. One of the foremost steps is defined as achieving increased agricultural productivity. The studies (World Bank, 2007; Abbott, Hurt and Tyner, 2008; Trostle, 2008; Alston, Beddow and Pardey, 2009; and Dorward, 2013) suggest that an improvement in agricultural productivity positively effects food supply and the level and volatility of food prices.

The agricultural sector is a very important sector in most countries and Turkey is no exception. The recent elevated level and volatility in food inflation damages the general inflation outlook, aggravates healthy price formation, adversely influences pricing behavior by increasing inflation uncertainty, leads to stiffness in inflation expectations and reduces room for maneuver of monetary policy. Considering the fact that food inflation accounted for approximately 20-30 percent of overall annual CPI inflation recently, it is evident that decreasing the level and volatility of food inflation would bring about important gains with respect to social welfare and monetary policy.

Utilization of high technology and modern equipment in agriculture brings about production growth. As the income structures of agricultural producers are not stable enough to realize the investments with their own funds, their working capital and investment needs are supported with loans. While access to technology and equipment in agricultural production is determined by the producers’ borrowing capacities, this capacity is highly dependent on the development level of agricultural banking. A developed agricultural financing system provides the producer with technical assistance when needed while purchasing technological machinery-equipment, choosing fertile farmland, construction / modernization of facilities, construction of irrigation structures and purchasing seeds/ seedlings/ livestock. In other words, agricultural producers’ access to loans significantly contributes to agricultural growth. Therefore, achieving an operational agricultural credit mechanism is very important for an economy.

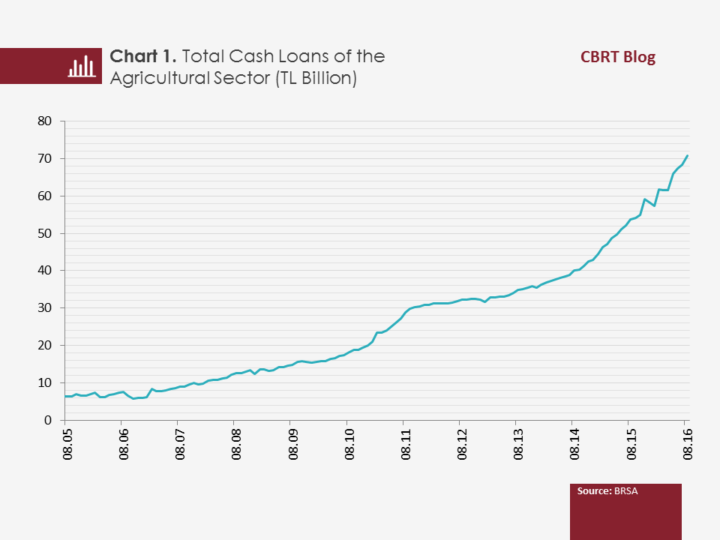

In Turkey, a significant proportion of total loans is composed of loans for consumption; the importance of agricultural loans, which will directly support agricultural production and so total production in the country, is a newly recognized issue. Public banks, which have been extending agricultural loans for a long time, have the largest share in agricultural loans in Turkey with a ratio of 68 percent. Private banks have made a big entrance into the sector by providing financing products designed to meet the needs of farmers other than conventional agricultural loans and received 32 percent from the total agricultural loans. They have played a pivotal role in the coining of the term “private agricultural banking” and helped to drive a 2.5-fold increase in agricultural loans over the last 5 years (Chart 1). Nevertheless, the ratio of newly extended agricultural loans in total loans is still quite low. This suggests that there is still a lot of space to be filled in with respect to agricultural loans. According to the data provided by the BRSA, the ratio of agricultural loans (fishery and forestry loans included) in total loans is 4 percent, but this ratio also includes general purpose loans drawn for agricultural purposes. According to the Food and Agriculture Organization of the United Nations (FAO) which focuses on more refined agricultural loan data, the ratio is 0.5 percent.

Another factor encouraging banks to extend agricultural loans is that the loan collection rate of agricultural loans is high. In June 2016, the ratio of non-performing loans was 2.4 percent in the agricultural sector; 3.3 percent in total loans and 4.2 percent in SME loans. Moreover, banks’ having insurance for risks that cannot be controlled by farmers such as drought, frost and flood would increase financial debt. In agricultural loans, farmers can meet their needs at the beginning of the season with interest-free loans and make their payments during the harvest period.

In Turkey, agricultural banking is a relatively new, profitable and ever-growing field, especially for private banks. However, the volume of agricultural banking in Turkey is quite low compared to other countries with high agricultural activity. An analysis of agricultural loans over the last 20 years in countries with developed farm sectors such as the USA, Israel, Italy and New Zealand reveals that the agricultural loan ratios in these countries are significantly higher than that of Turkey. In developing countries such as Brazil, Mexico and Thailand, the ratio of agricultural loans in total loans is also significantly higher than in Turkey. Therefore, Turkey has a great potential to increase the ratio of agricultural loans in total loans.

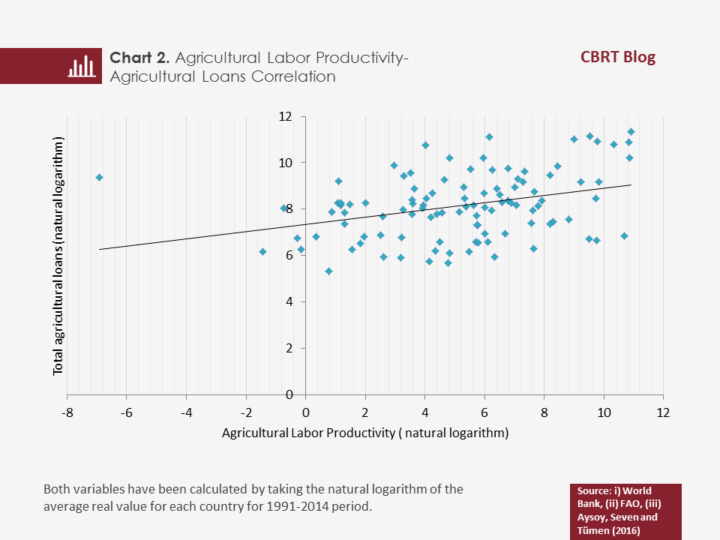

An increase in agricultural loans offers new opportunities for the agricultural sector. In their study (2016), Aysoy, Seven and Tümen analyzed the relation between the development level of agricultural banking and agricultural productivity by utilizing the FAO’s country-based data for 1991-2014 and revealed that the higher the level of agricultural loans, the higher the agricultural productivity. In Chart 2, it can be easily observed from the plain country data that there is a positive correlation between agricultural labor productivity and total agricultural loans.

To conclude, it can be asserted that establishing a modern agricultural finance model in Turkey will likely increase agricultural productivity significantly. According to FAO data, the ratio of newly extended agricultural loans in total loans in Turkey over the last 10 years was approximately 0.5 percent. The sector is targeting to achieve 10 percent. The regression coefficients in Aysoy, Seven and Tümen’s study (2016) suggest that achieving this target can bring about a 100 percent rise in agricultural production. In this respect, provided that an effective growth strategy for agricultural loans is implemented, the contribution of the agricultural sector to the overall economy is expected to increase significantly. In particular, the microcredits to be provided to producers with an expert view will enhance productivity and contribute to solving structural problems in Turkish agricultural sector. Encouraging the banking sector to achieve product proliferation in agricultural loans and concentrate more on extending microcredits intended for agricultural machinery-equipment and production technologies would be a valuable policy recommendation that will improve agricultural productivity.

Bibliography:

Abbott, P. C., C. Hurt and W. E. Tyner (2008). “What’s driving food prices?” Farm Foundation Issue Report, Farm Foundation, Oak Brook , IL , July.

Alston, J. M., J. M. Beddow and P. G. Pardey (2009). “Agricultural research, productivity, and food prices in the long run.” Science, 325, 1209–1210.

Aysoy, C., Ü. Seven and S. Tümen (2016). “Agricultural credits and agricultural productivity: Cross-country evidence.” Central Bank of the Republic of Turkey, unpublished manuscript.

Dorward, A. (2013). “Agricultural labor productivity, food prices, and sustainable development impacts and indicators.” Food Policy, 39, 40–50.

Trostle, R. (2008). “Global agricultural supply and demand: Factors contributing to the recent increase in food commodity prices.” Outlook Report No. WRS-0801, Economic Research Service, U.S. Department of Agriculture , Washington , DC , May.

World Bank (2007). World Bank Development Report 2008, World Bank, Washington, DC.