Knowing how much imported input is used during production by export companies is important with respect to better understanding the prospective impacts of exchange rate fluctuations on exports and the general economy. The related studies in literature generally estimate the imported input content of exports by using macro data based on sectors (Erduman et al., 2019; OECD, 2019; Özcan-Tok and Sevinç, 2019). These studies calculate the imported input ratio of exports in Turkey as approximately 20%.

In a recent study, we tried to measure imported input dependence of exports using micro-level data. In this context, we mapped a network of exporters and their suppliers by using administrative customs records and buying and selling declaration forms between firms. Using this information and indirect effects, we estimated the imported input ratio [1]. When the supply networks of exporters are taken into account, the imported input ratio estimated based on micro data appears to be twice the imported input ratio estimated based on macro data. When the shares of imported input in the production costs of export companies, suppliers of these export companies and suppliers of these suppliers are considered, the average imported input component in exports is calculated as approximately 45%.

What is the reason for the discrepancy between calculations on the firm level and the sector level?

The first step of calculating the imported input by using data on a sector level was comparing total imports with sales on the sector level. Apart from the imports of the sector, the ratio of imported inputs from the supply chain was also taken into account by using intersectoral input-output tables issued by TurkStat in 2002 and 2012. To calculate the imported input ratio in exports, we used an imported input average that is weighted by the contribution rates of sectors to total exports.

As the imported input ratio calculated by using consolidated data by sectors relies on the assumption that all firms in the sector are homogenous, it ignores two important trends:

- Export companies are likely to be import companies as well,

- Larger companies that play an important role in the supply chain of exporters have a higher imported input ratio.

Table 1, which shows average characteristics of companies in the administrative customs data, presents these two trends. In our Akgunduz and Fendoglu (2019) study, we were able to consider these trends by using administrative customs records and supply-purchase documents between companies. Moreover, instead of the input-output tables prepared for only two years (2002 ve 2012) and listed on a sectoral basis, the study allows input-output calculations on a yearly basis and for each company.

We estimated the imported input ratio on firm level by using micro data in three steps. First of all, we proportioned the imports of the company in that year according to the customs data to the cost of sales reported in the firm's balance sheet. This calculation gives us the imported input ratio used in the Amiti et al. (2014) study. In the second step, we compiled the inter-firm trade data by using the purchase and sales invoices declared by the firms. We determined the companies that each company purchases from in the supply chain and we calculated the average of imported inputs of supplier companies. While doing so, we appropriately weighed each supplier for each exporter. Then, in order to reflect the importance of goods / services received from the supply network for an exporter firm in the production / export activities of that firm, we multiplied the weighted average imported input ratio of the suppliers with the ratio of procurement cost to total sales cost of the exporter company. Chart 1 summarizes these steps in a visually simplified way. Using the same method, we went one step further in the supply chain and attained the aggregated imported input ratio in the export that we used. To sum up, the imported input ratio that we estimated is created by taking into account the imported input ratios of the exporter company, its suppliers and suppliers of suppliers.

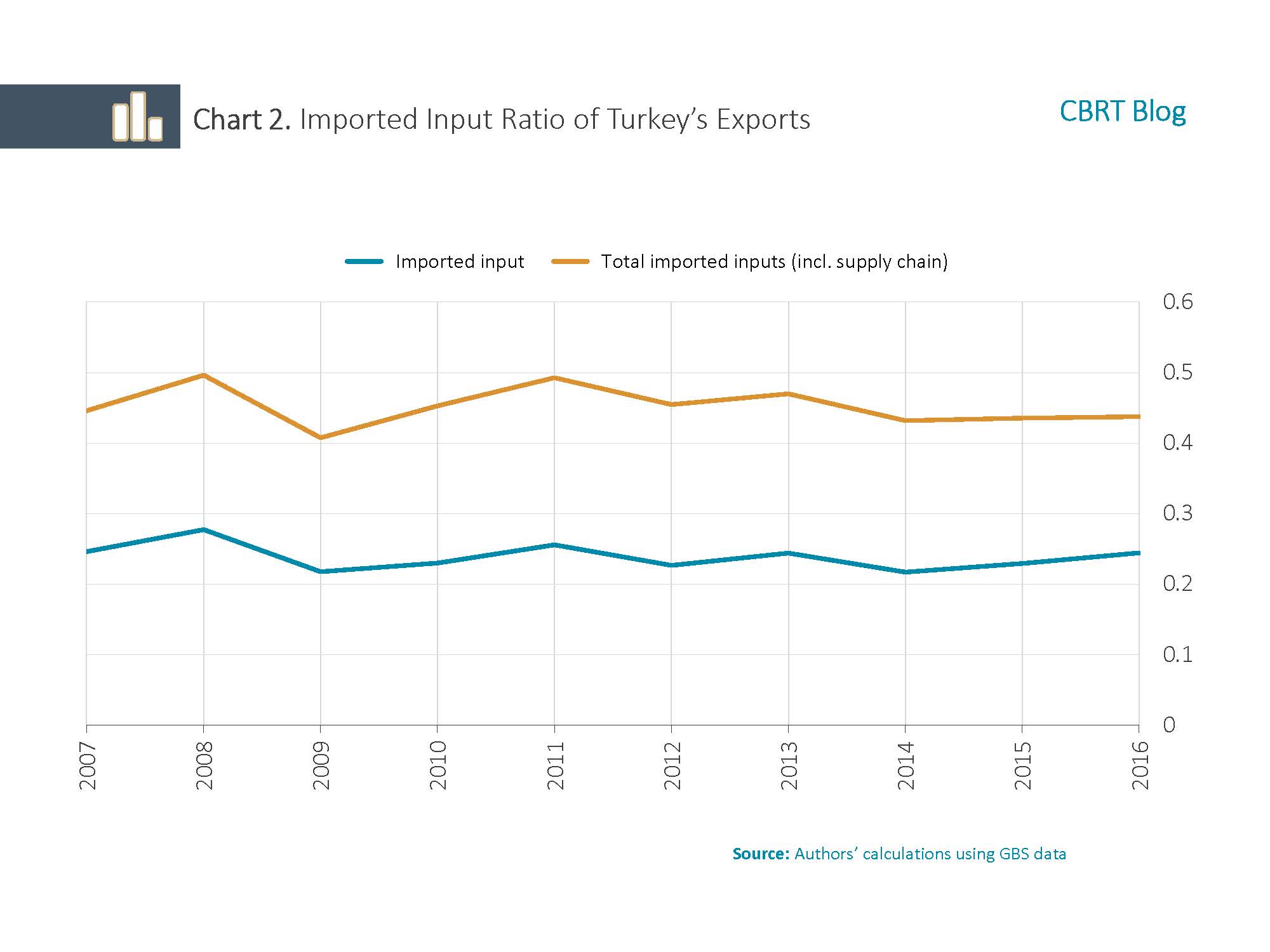

In Turkey, between 2006-2016, 99% of export companies used imported input supplied by themselves or suppliers. The ratio of imported input calculated above and proportioned to the cost of sales, which was calculated as 22%, rises up to 45% when the supply chain is taken into account. Chart 2, which shows the averages between 2006 and 2016, confirms that the imported input ratio was stable. The decrease in 2008-2009, when the global crisis was experienced, indicates that the use of imported inputs was cyclical.

Does the Imported Input Component Affect Firms’ Export Performance?

The imported input share in exports has important impacts during periods of exchange rate fluctuations. In the Akgündüz and Fendoğlu (2019) study, we examined imported input dependency among exporters that have exported the same good to the same country in the same year. Our aim was to analyze if exporting companies, which were directly or indirectly dependent on imported input, were able to make competitive pricing on their export goods after a depreciation in Turkish lira. The results showed that firms with high direct or indirect import input utilization were not able to make competitive pricing during periods of depreciation in the Turkish lira, therefore, the expected increase in exports remains limited after a depreciation in exchange rates.

[1] For details, please see Akgündüz and Fendoğlu (2019)

References

Akgündüz, Y. E., and Fendoğlu, S. (2019). Exports, Imported Inputs, and Domestic Supply Networks. CBRT Working Paper 19/08.

Amiti, M., Itskhoki, O., and Konings, J. (2014). Importers, exporters, and exchange rate disconnect. American Economic Review, 104(7), 1942-78.

Erduman, Y. Eren, O., and Gül, S. (2019). Türkiye’de Üretim ve İhracatın İthal Girdi İçeriğinin Seyri: 2002-2017, CBRT Working Paper 19/09. (Available only in Turkish)

OECD (2019) Import Content of Exports, https://data.oecd.org/trade/import-content-of-exports.html, Erişim tarihi 05/2019, Organization for Economic Cooperation and Development, Paris.

Özcan-Tok, E., and Sevinç, O. (2019). Üretimin İthal Girdi Yoğunluğu: Girdi-Çıktı Analizi. CBRT Working Paper 2019-06. (Available only in Turkish)