Firm defaults are one of the key indicators closely monitored for financial stability during periods of monetary tightening. In this blog post, we analyze how firm defaults have evolved across various monetary tightening episodes. Specifically, analyzing changes in firm defaults by size and sector in the recent tightening episode, we draw conclusions regarding the role of financial indebtedness.

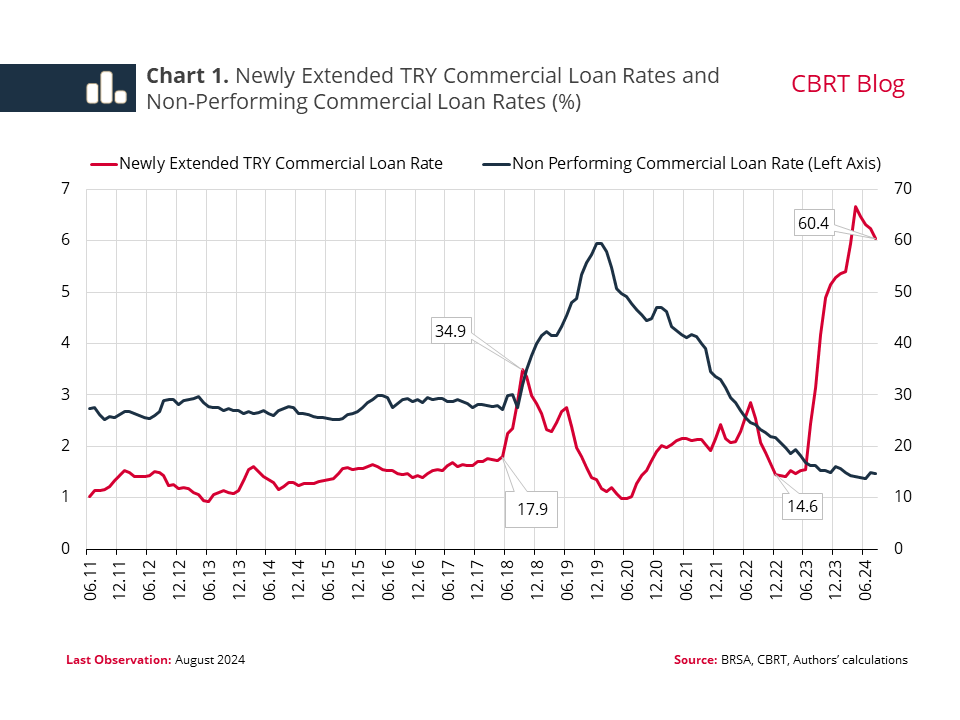

Historically, commercial loan rates increased during the tightening periods of 2018 and 2023. However, while non-performing loans (NPLs) picked up during the 2018 tightening period, they remained relatively low in the 2023 period (Chart 1). The CBRT raised the monetary policy rate from 8% to 24% in four months starting June 2018, and maintained that rate until July 2019. Correspondingly, commercial loan rates rose from 17.9% before tightening to 35%. In this tightening cycle, commercial NPL ratios surged from 3% pre-tightening to 6% by the end of 2019. In contrast, during the current tightening period, commercial NPL ratios hovered around 1.5%. This divergence is attributed not only macroeconomic factors such as the timing of rate hikes, the level of inflation, exchange rate fluctuations and geopolitical developments, but also to firm- and sector-specific characteristics.

We conduct firm-based vintage analyses to highlight the correlation between the divergence in defaults and firm characteristics across the two tightening periods. Vintage analysis tracks firms that were classified as healthy at a given time and monitors their default rates in the subsequent period.[1] For our purposes, the period following June 2014, when interest rates remained flat, serves as a reference. During this period, the default rate among firms approached 5% over 16 months. In contrast, during the 2018 monetary tightening period, the default rate among healthy firms was higher compared to the 2014-2015 period. The divergence in default rates became evident within six months of the onset of the hiking cycle.

We present a summary of the percentage of healthy firms that defaulted within 16 months from the start of the analysis, broken down by firm size and indebtedness level (Table 1). We categorized firms into three groups in terms of size as micro, medium and large; and also into three groups according to their indebtedness level as low, moderate and high, based on the ratio of the firm’s loan balance to its net sales.[2] A comparison of firm defaults by indebtedness and size during the June 2018-September 2019 tightening period, and the June 2014-September 2015 period, when interest rates remained stable, reveals that the rise in defaults was more pronounced among medium and large firms with higher levels of indebtedness.

Our findings reveal a positive correlation between indebtedness and default probability, with this relationship becoming stronger when interest rates rise compared to periods when they remain flat. In other words, the sensitivity of defaults to indebtedness increases in a high interest rate environment. Accordingly, firms with higher levels of indebtedness are expected to be more adversely affected by the interest rate hikes initiated in June 2023 than other firms. However, the comparison period used in this analysis and the current high interest rate period differ in several important aspects, such as economic momentum, the pace of interest rate hikes, banks’ risk-bearing capacity, and corporate sector indebtedness. For instance, the corporate sector indebtedness and the current NPL ratios are markedly lower during the 2023 monetary tightening period compared to previous periods, largely due to the inflationary environment (Chart 3). Furthermore, when compared to 2018, the corporate sector’s FX short position has improved considerably, enhancing its resilience to exchange rate shocks (Chart 4). In this regard, it can be stated that banks’ credit risk-bearing capacity and firms’ debt-bearing capacity are higher than during the periods compared. This suggests that the corporate sector and the banking sector are more resilient to credit defaults in the current environment.

To demonstrate the differences in firm defaults between the post-June 2023 and in the 2018-2019 period, we extended the vintage analysis to cover the period between June 1, 2023, and August 31, 2024. We then compared the default progression of firms classified as healthy as of May 2023 with that of previous periods. The results show that the default rates of firms that were healthy in May 2023 are significantly lower than during the 2018-2019 tightening period, as well as the post-June 2014 period when interest rates remained unchanged. Additionally, both the actual default rate and the pace with which defaults occur are following a considerably more favorable trajectory in the current period. At the sectoral level, the positive divergence in the 2023 period is quite evident and homogeneous across sectors. In conclusion, the current default rates among firms remain moderate, largely due to the gradual approach to monetary tightening and the reduced domestic and foreign currency debt burden of the corporate sector. However, firm default rates continue to be a critical indicator that need to be closely monitored to ensure price stability and financial stability.

[1] Healthy firms are defined as firms that have performing cash or non-cash loan balances and are not in default.

[2] The size classification is based on end-2018 revenues: Firms with a revenue of TL 1 million or less are classified as “micro”, firms with a revenue between TL 1 million and TL 50 million are classified as “medium”, and firms with a turnover of TL 50 million or more are classified as “large”. Indebtedness is defined based on firm’s loan-to-revenue ratio. Firms with a loan-to-revenue ratio below 5% are classified as having “low indebted firms”, those with a loan-to-revenue ratio between 5% and 50% are classified as “moderately indebted firms”, and firms with a loan-to-revenue ratio above 50% are classified as “high indebted firms”.

References

Bağır, Y.K., Seven, Ü., Tok, E. (2024). Yükselen Ticari Kredi Faizlerinin Firmaların Temerrüt Olasılıklarına Heterojen Etkisi Üzerine Bir İnceleme [Investigating the Heterogeneous Effects of Rising Commercial Loan Rates on Firms’ Default Probabilities] (in Turkish only). CBRT Research Notes in Economics, 2024-11.