External demand lost momentum in 2023 due in part to the global monetary tightening, limiting exports. In 2024, however, Türkiye’s exports grew by 3.9% year-on-year to USD 170.8 billion in the first eight months. This blog post examines the impact of external demand conditions and market share developments on Türkiye’s exports to the European Union (EU), Türkiye's largest export market, by sector, using Eurostat’s monthly international trade data.

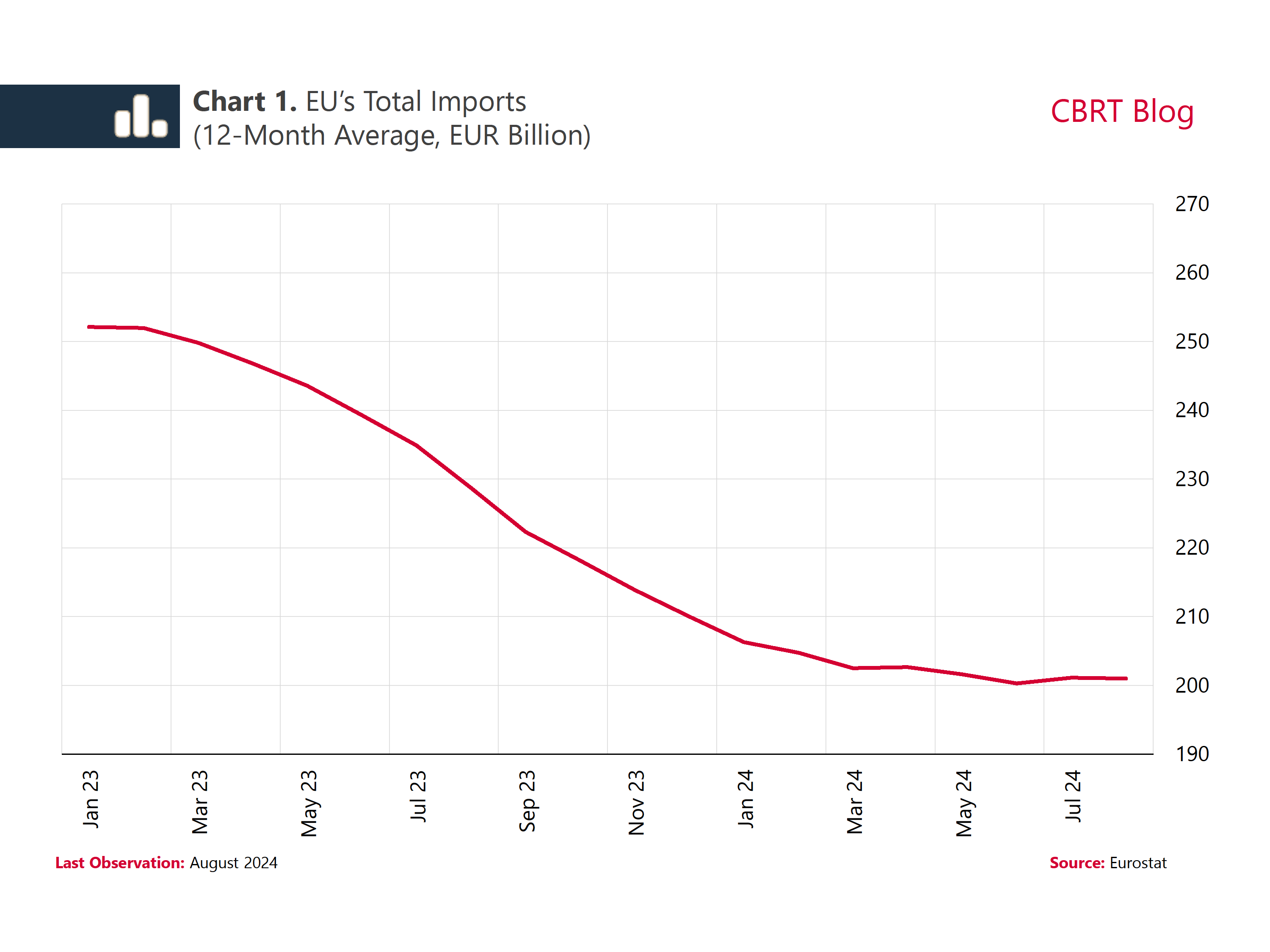

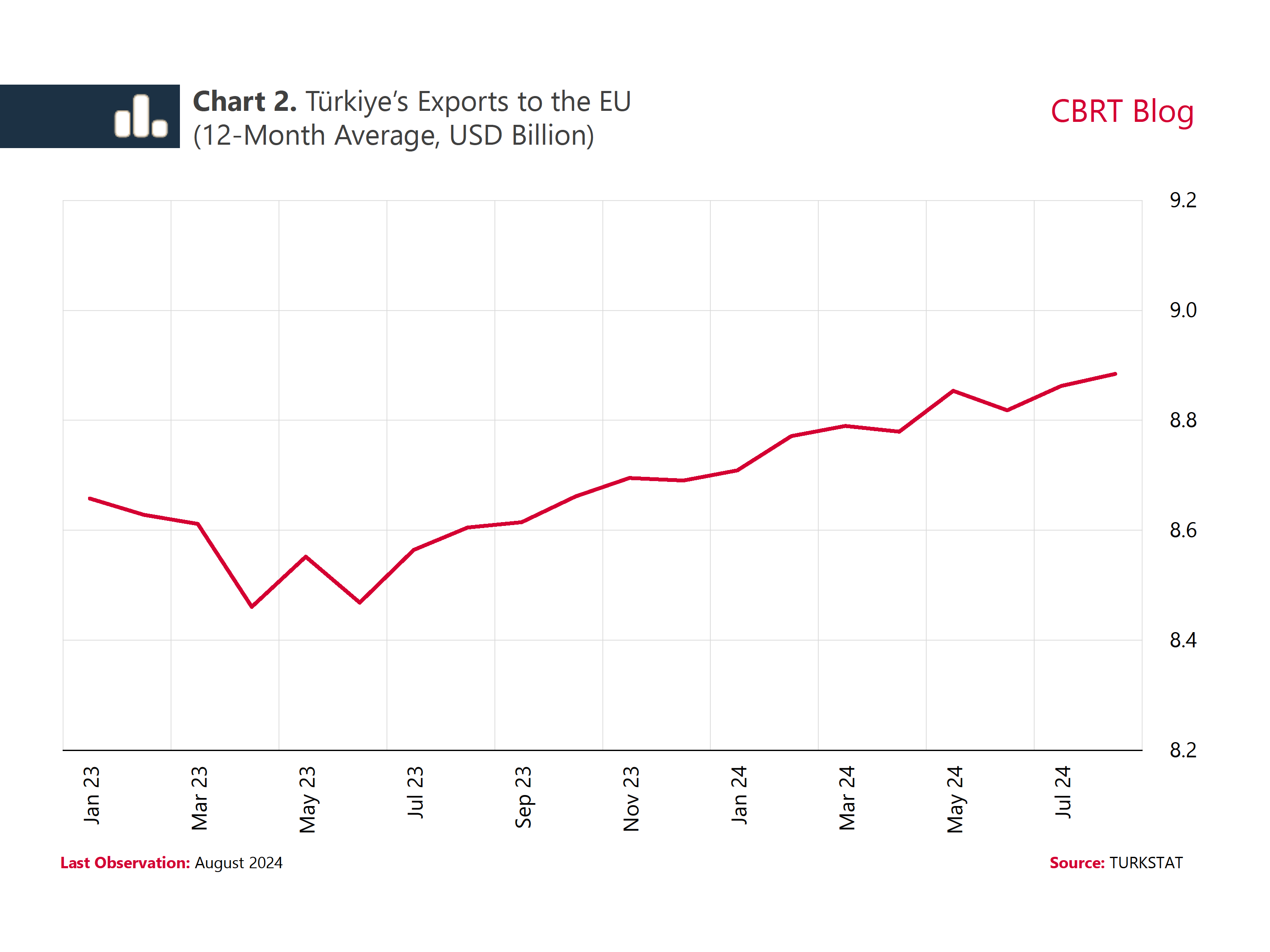

The EU’s total imports have been on a downward trend since early 2023, with monthly averages decreasing from EUR 252 billion in January 2023 to EUR 201 billion in August 2024 (Chart 1). Despite unfavorable demand conditions in the EU, Türkiye's exports to the EU rose from a monthly average of USD 8.7 billion to USD 8.9 billion over the same period (Chart 2).

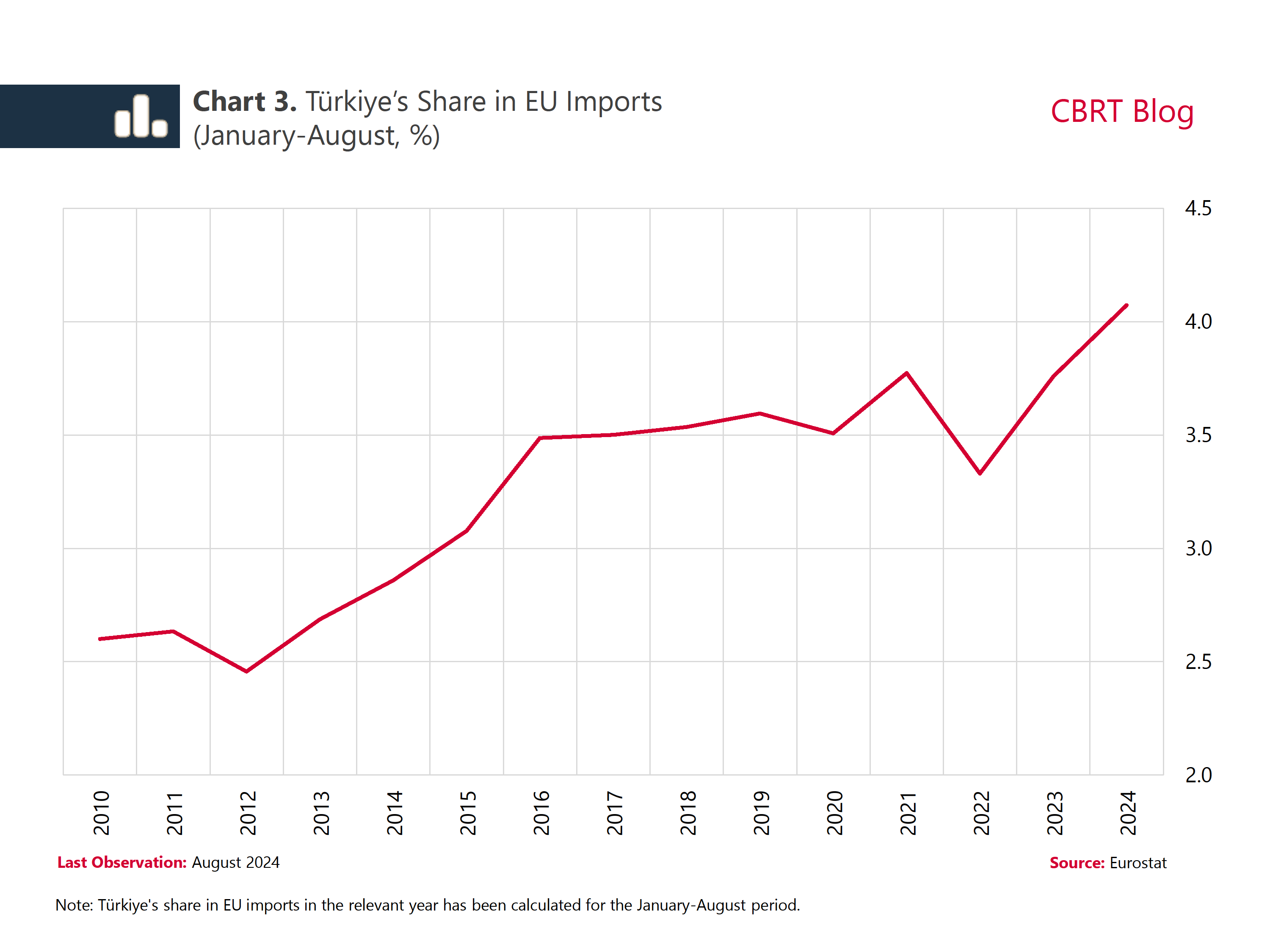

Recent data reveals significant gains in Türkiye's market share within the EU. During January-August 2024, Türkiye's share in EU imports reached a historic high of 4.1% (Chart 3). However, the reliance on specific sectors for growth could pose a sustainability risk. Analyzing sector-specific growth and market share increases can shed light on exports and help predict future export performance.

To this end, we decompose the change in exports by sectors into the contributions of “external demand” and the change in “market share” within the EU. We calculate the demand-driven change as follows:

- First, we calculate the shares of relevant manufacturing sectors in EU imports for the January-August 2023 period.

- Next, we calculate the change in EU’s annual sectoral imports for the January-August 2024 period.

- Finally, we multiply the shares by the changes in the EU’s sectoral imports to obtain the contribution of EU demand to Türkiye's exports to the region.

Subtracting this demand-driven change from the actual change in EU imports from Türkiye in each sector, we obtain the market share-driven change—the contribution of market share gains to the sectoral change in Türkiye's exports to the EU.

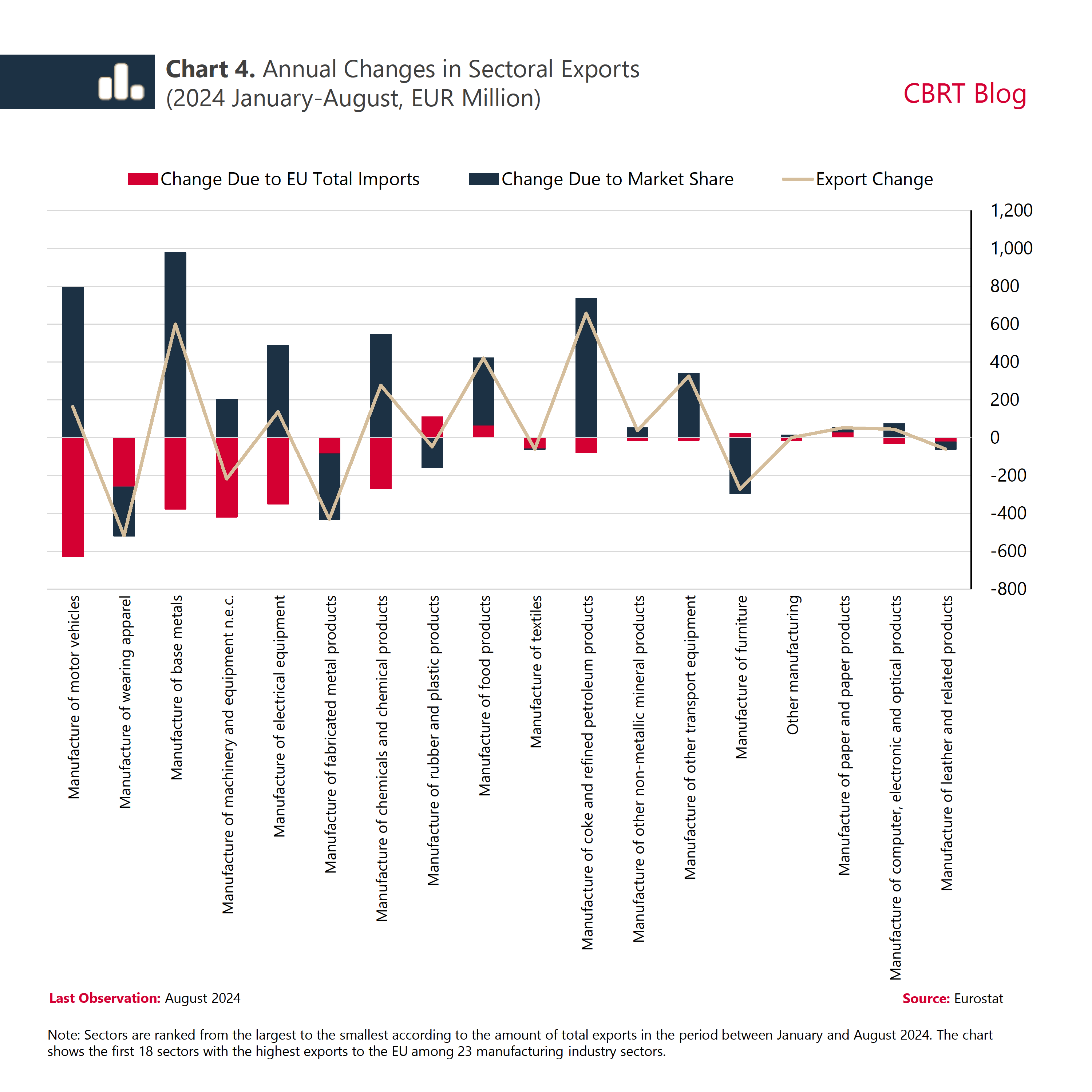

The results show that, despite negative impacts from declining EU demand across nearly all sectors, Türkiye managed to expand exports in most sectors by increasing market share (Chart 4). This indicates that Türkiye’s competitiveness in the EU market has increased. For example, in motor vehicle manufacturing,—the largest contributor to Türkiye's exports at 21%—EU demand declines led to a EUR 630 million reduction in exports in the first eight months of 2024 compared to the same period in 2023. Meanwhile, market share gains contributed EUR 793 million, increasing the sector's total exports by EUR 163 million. The largest contribution of market share gains to exports was in the base metals manufacturing sector with EUR 976 million. Overall, the decline in EU imports dampened (EUR 2.4 billion), while market share gains bolstered (EUR 3.5 billion) exports, paving the way for a EUR 1.1 billion increase in total manufacturing exports.

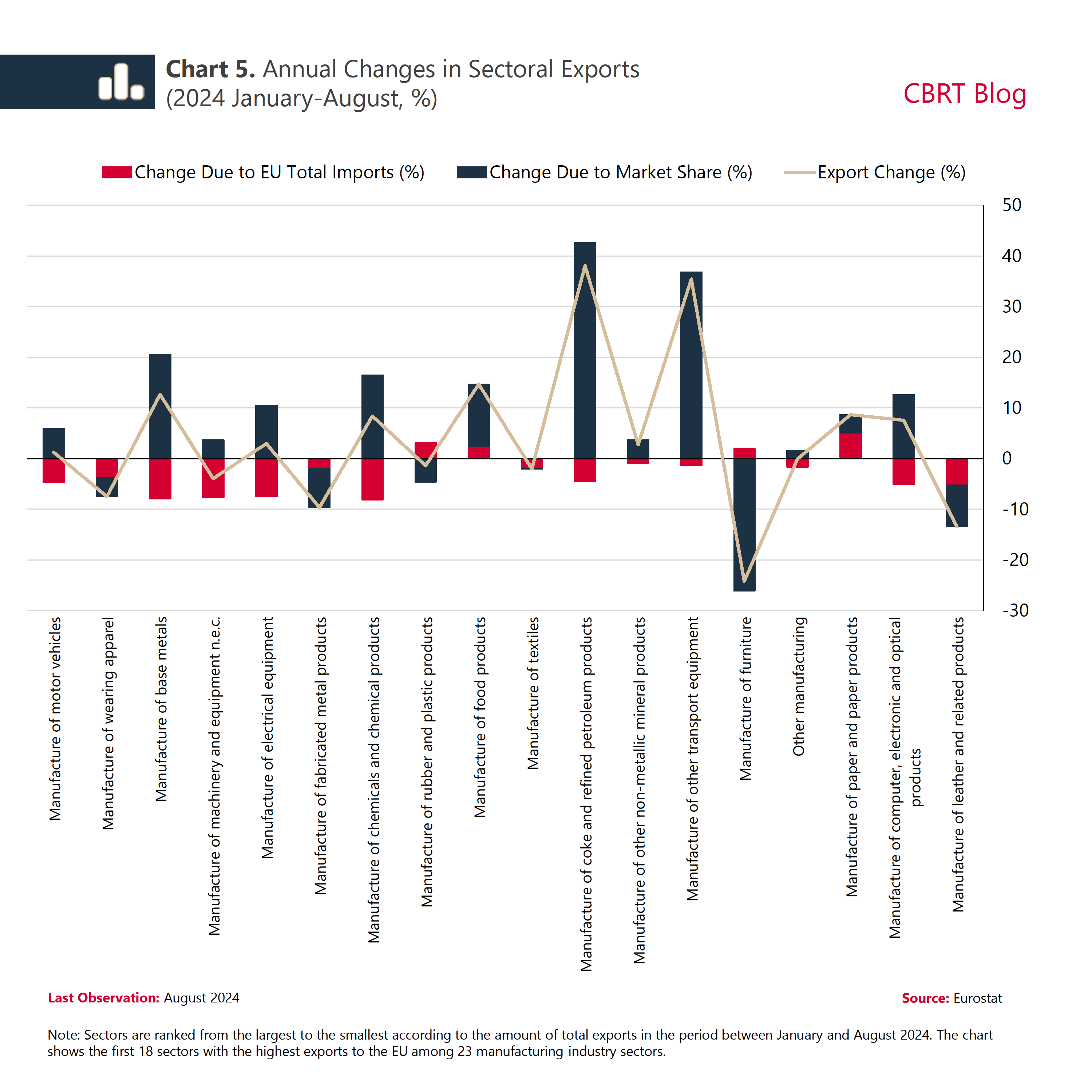

In addition, we calculate the contributions to sectoral export changes as percentage points by dividing the effects of EU market share and demand (in euros) by sectoral exports for January-August 2023 (Chart 5). For the motor vehicle sector, market share gains added 5.9 percentage points to export growth, countering a 4.7 percentage points decline from reduced EU demand, resulting in a 1.2 total growth. Significant market share contributions also came from petroleum products and other transport equipment sectors. Moreover, exports also increased in the manufacture of base metals, chemical products, electrical equipment, non-metallic minerals and computer and electronic products sectors on the back of market share gains despite falling import demand. On the other hand, sluggish demand conditions played a role in the decline in exports of wearing apparel, machinery and equipment, fabricated metal products, textiles, and leather products.

To sum up, our findings suggest that Türkiye's market share in the EU has recently surged and this surge has spread across many sectors. With expectations for increasing EU import demand, both market share gains and rising external demand should further support Türkiye’s export growth.