Fiscal policy, through the instruments it employs, can have an impact on economic activity, either on the supply side or through demand. In the short run, it can have a stimulating effect on economic activity from the demand side through tax and spending policies. In the long run, it can affect the economy from the supply side by improving investment conditions and enhancing the potential production level of the economy.

Amongst the objectives of investment incentives in Turkey are boosting investments, increasing employment by creating new business areas and alleviating inter-regional discrepancies in terms of development.

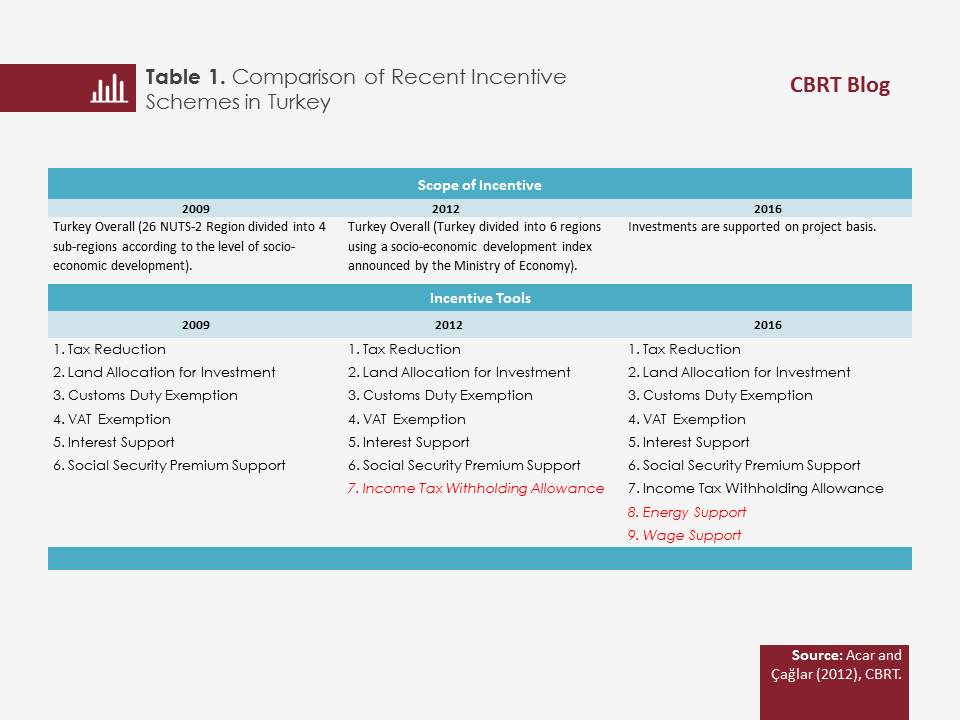

The new incentive scheme that was designed from scratch with a broader coverage in 2009 expanded the range of investment fields subject to incentives and prioritized improvement of related macro-economic indicators such as exports, imports, competitiveness and employment. Similar to the previous one, the New Incentive Scheme that was launched in 2012 also offered cost-related incentives as given in Table 1.

The incentive system launched in 2012 aimed to encourage investments that would enable strategic and technological transformation, contribute to the development of the least favored regions, enhance the effectiveness of support instruments, and remove regional discrepancies.

What distinguishes the 2016 incentive scheme from previous schemes is that it is project-based. Another striking novelty is that the new scheme offers incentives for energy and wage support in addition to existing tools.

It is noteworthy that the wider scope and regional coverage introduced in the 2009 and 2012 incentive systems brought increases in the following years not only in the amount of investment that was awarded incentives but also in the number of jobs pledged to be created.

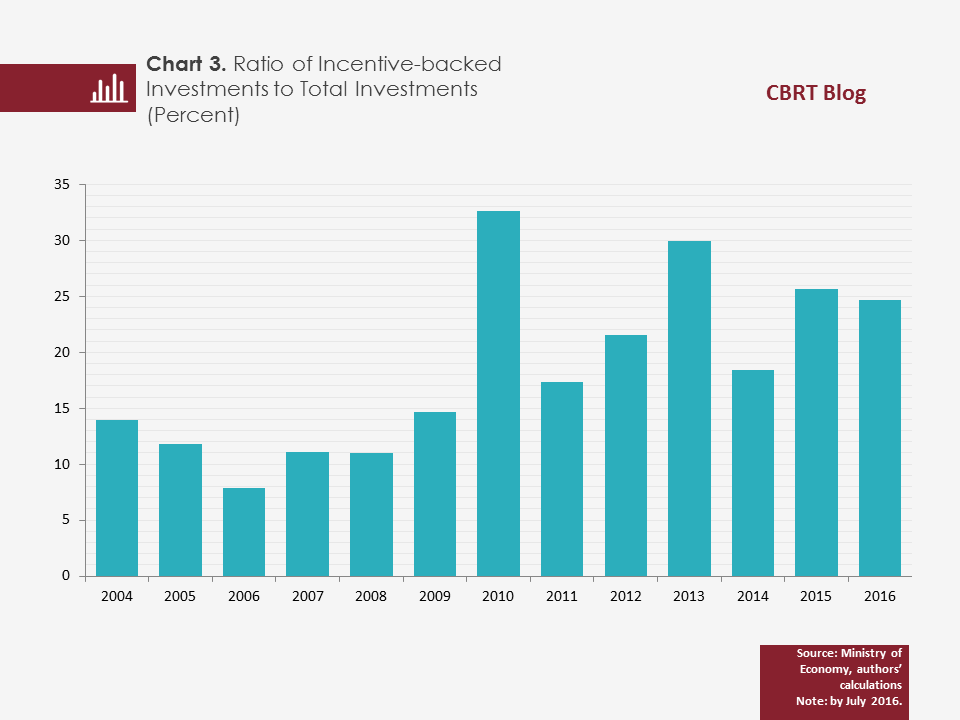

Moreover, the ratio of incentive-backed investments to total investments increased during years following the implementation of incentive schemes. Such schemes, with wider variety of instruments and higher number of regions covered, become more influential on investment, growth and employment.

Consequently, the incentive schemes implemented in Turkey spur economic growth mainly through tax reductions and other government subsidies, and contribute positively to the increase of investment and employment, thereby diminishing socio-economic discrepancies among regions.

*This analysis is based on the information note on “Main Characteristics of Incentive Schemes Recently Launched in Turkey”, prepared by Ali Çulha and Erdal Yılmaz. This study is also included as a Box in the Inflation Report 2016-IV.