Turkey is a net energy importer. That is why energy prices determined in international markets are a cost factor to be considered. What is more, fluctuations in the exchange rate put an additional pressure on energy costs (Chart 1). It is to be noted that energy prices have a significant share both in household expenditures and production costs of the manufacturing industry (Chart 2)[1]. In this respect, pricing of the energy items used by the household and firms differs from that of other goods and services. Thus, an analysis of energy pricing policies of countries reveals that prices are directly determined –partly or fully-by the state or the state has an active role in energy pricing policies through the tax policy channel in a fully-privatized energy market. A similar dual case applies to Turkey as well. For example, although fuel prices are determined in the free market, tax adjustments have an apparent weight on the final sales prices, or electricity and natural gas prices are determined with the approval of the Energy Market Regulatory Authority (EPDK). In this blog post, we analyze the indirect effects of adjustments in electricity and natural gas prices placed under the producer and consumer price indices on consumer inflation.

Through Which Channels Do Energy Prices Pass Through to Inflation?

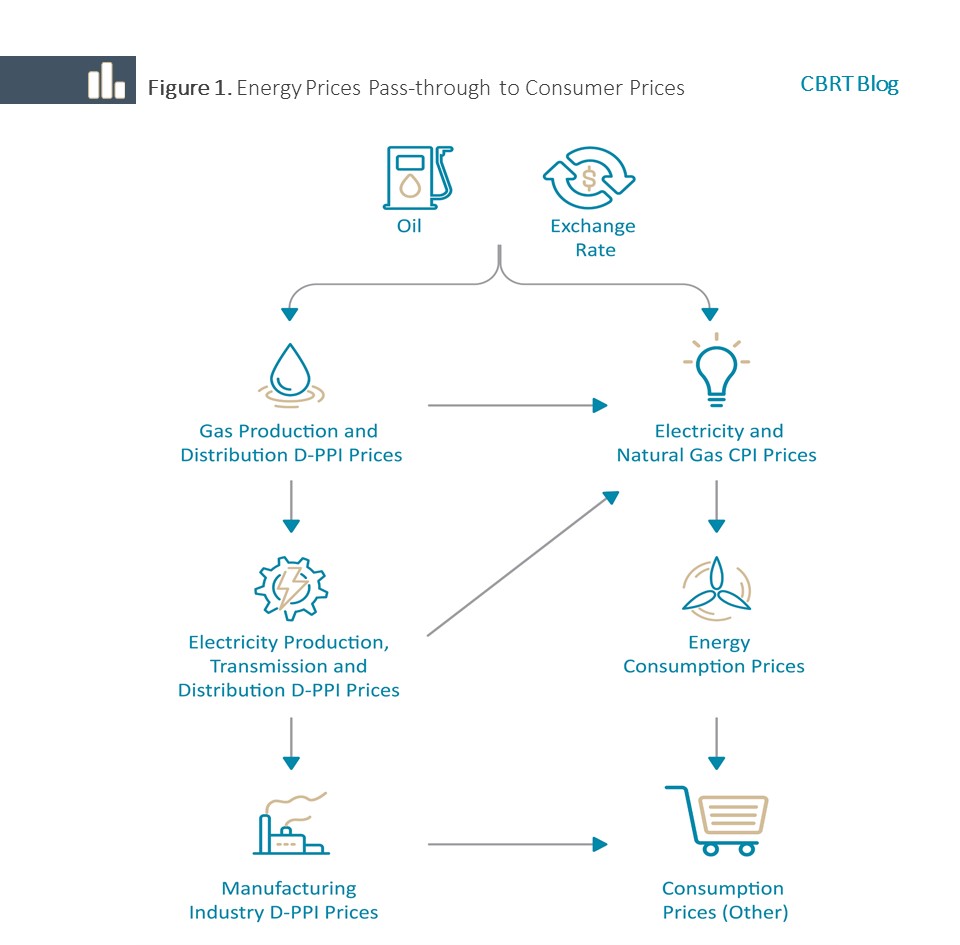

Strategies towards energy pricing have an effect on inflation as well and this effect is not solely limited to the share of these goods within price indices. Indirect reverberations of adjustments in administered energy prices on inflation can be observed through production and operating costs or relative prices channels (Figure 1).

Let us first have a look at producer prices to analyze the indirect effects of adjustments in electricity and natural gas prices on consumer inflation. The first thing worth noting is the pass-through between the energy items. As a portion of electricity production in Turkey is made through natural gas power plants, producer price increases in natural gas put pressure on producer prices of electricity. On the other hand, increased electricity prices in industry affect manufacturing industry prices directly through the production costs channel. Then, this increase in manufacturing prices may translate into indirect effects on consumer prices.

Secondly, increases in electricity and natural gas prices included in the CPI may also have indirect repercussions on consumer prices. Although consumer prices include only electricity and natural gas prices used in housing, for example, price adjustments in housing can affect energy prices in commercial establishments. Through this channel, indirect reverberations can be seen on prices of groups such as services, core goods or processed food as well.

Which Modeling and Identification Strategy Should be Followed?

To analyze indirect effects of electricity and natural gas prices on consumer inflation, we estimate various vector auto regression (VAR) models. Via the impulse-response functions generated from these models, we analyze the effects of adjustments in energy prices on inflation in terms of size.

Firstly, to be able to identify indirect effects on producer prices, we start with a VAR model composed of five variables. This model includes TL-denominated crude oil prices, gas production prices, electricity production prices, output gap and manufacturing sector prices of the domestic producer index (D-PPI).[2] For a proper identification of the effects, changes in the USD/TL exchange rate (with lagged values) are added to the model as exogenous variables. This model is expanded to include the prices of a different core consumer subgroup (processed food, core goods and services) each time so that indirect effects of producer price adjustments on the main sub-groups of consumer prices can be calculated.

Secondly, we take a look at the indirect effect of the changes in consumer prices of electricity and natural gas on the main groups of CPI excluding energy. To this end, we construct a price index including electricity and natural gas items for consumer prices.[3] Another point should be noted here while constructing the model. We see that in general, electricity and natural gas price adjustments for the industry and the consumers coincide frequently (Chart 3). Therefore, it is preferable to control simultaneous adjustments for producer prices while looking into the indirect effects of energy price adjustments for consumers. The VAR model estimated to this end includes TL-denominated crude oil prices, producer electricity-natural gas prices, consumer electricity-natural gas prices, output gap and a sub-group of headline consumer index (processed food, core goods and services), respectively. The change in the USD/TL exchange rate again stays as an exogenous variable. This enables us to observe indirect effects on consumer prices based on core groups.[4]

What do forecasts tell us?

Using the impulse-response functions obtained from models, we calculate the indirect effects of increases in producer and consumer prices of electricity and natural gas on consumer prices through processed food, core goods and services. Our estimates are reported in the table below (Table 1).

This table shows that while the direct effects of a 10-percent increase in electricity and natural gas prices in CPI are 0.30 and 0.18 percentage points, respectively; the indirect effects of these increases on consumer prices are calculated as 0.20 and 0.12 points on average, respectively. However, based on estimation and model uncertainty, the indirect effect of adjustments in electricity prices may be between 0.15 and 0.29 points and adjustments in natural gas prices may be in the range of 0.09 and 0.18 points.[5] Meanwhile, increases in electricity and natural gas prices in D-PPI have indirect effects on consumer prices through the rise in production costs. Accordingly, we estimate indirect effects of a 10-percent raise in electricity and natural gas prices in D-PPI on consumer prices within the range of 0.12-0.16 and 0.10-0.13 points, respectively.

In sum, we can state that the indirect effect of electricity and natural gas price adjustments on inflation can amount to at least half of their direct effect.

[1] In terms of the costs of firms, Yüncüler and Öğünç (2015) calculate the share of electricity expenses in the manufacturing and service sectors as 2.3% and 1.9%, respectively.

[2] In this blog post, models estimated with monthly data for the post-2010 period include stationary forms of the variables.

[3] We prefer using the aggregate index both to keep the number of variables in VAR reasonable and to eliminate possible pass-through between these items. This implies that the size of indirect effects of electricity and natural gas price increases on other prices relative to direct effects is identical for these two items. Additional analysis made separately for items verifies this assumption.

[4] Core goods, services and processed food subgroups, which fall within the scope of a core indicator index B, are taken into consideration in the analysis of the indirect effects on consumer prices. However, indirect effects of electricity-natural gas on other energy items such as water and solid fuels; or on unprocessed food may also be observed.

[5] When estimating the indirect effects of electricity-natural gas increases in CPI, inferences regarding estimation uncertainty were made by introducing changes in producer prices in VAR models in different ways.

Reference

Yüncüler, H.B. G. & Öğünç, F. (2015). “Firm Cost Structure and Cost-Push Factors of Inflation”, CBRT Working Paper Series, No. 15/03.