Financial conditions, conceptually, summarizes whether financial indicators such as interest rates, exchange rates, asset prices and credit conditions are being restrictive or accommodative on economic activity. Prior to the global financial crisis, it was generally accepted that the current and expected future short-term interest rates determined by the central banks were broadly adequate to represent the financial conditions. This approach was based on the assumption that balance sheet constraints were negligible and the transmission of monetary policy rate on the economy was mostly stable and predictable. Nevertheless, the complex interaction between the financial sector and the real economy during the post-crisis period reminded us that the relationship between short-term interest rates and overall financial conditions may weaken substantially. Besides, balance sheet constraints on the financial sector can sometimes be quite binding for financial intermediation and economic activity, regardless of the stance of monetary policy. Moreover, the sensitivity of domestic financial conditions to global liquidity and risk appetite, especially in emerging countries, may further weaken the relationship between the monetary policy and the financial conditions. Therefore, developing a comprehensive view of the overall financial conditions has become increasingly important.

Accordingly, many countries have developed measures of financial conditions by aggregating an array of indicators pertaining to the financial system. These measures, which compile and summarize the information content of financial markets regarding the economic outlook, are generally called “financial conditions indices” (FCI). Recently, these indices have been widely used and followed by central banks. Typically, these indices combine a weighted average of financial indicators such as exchange rates, interest rates, risk premium, credit conditions and the yield curve, where the weight of a particular component depends on its power to forecast economic activity.

For a central bank focusing on price stability under an inflation targeting regime, financial conditions are important to the extent that they contain information about the output gap and inflation. For instance, in a period marked by tight financial conditions due to balance sheet constraints and economic sentiment, accommodative monetary policy is less likely to lead to inflationary pressures. Therefore, financial conditions stand out as an important concept with respect to monetary policy communication.

Recently, studies in the economic literature have been more intensely emphasizing the importance of FCI in assessing the impacts of conventional and unconventional policies. In fact, transmission of monetary policy to the real economy takes place mainly through financial conditions. Not only the level and the path but also the impact of the policy rate on real economic activity through financial conditions is important. The monetary policy rate itself is only one of the many components of financial conditions, while the interaction between the policy rate and other financial indicators also plays a crucial role in the transmission mechanism. For example, the impact of the short-term policy rate on the credit market and the exchange rate may be time varying. Monitoring overall financial conditions can provide policy-makers with valuable information, especially in cases where multiple policy instruments such as reserve requirements and risk weights are used in conjunction with policy rates.

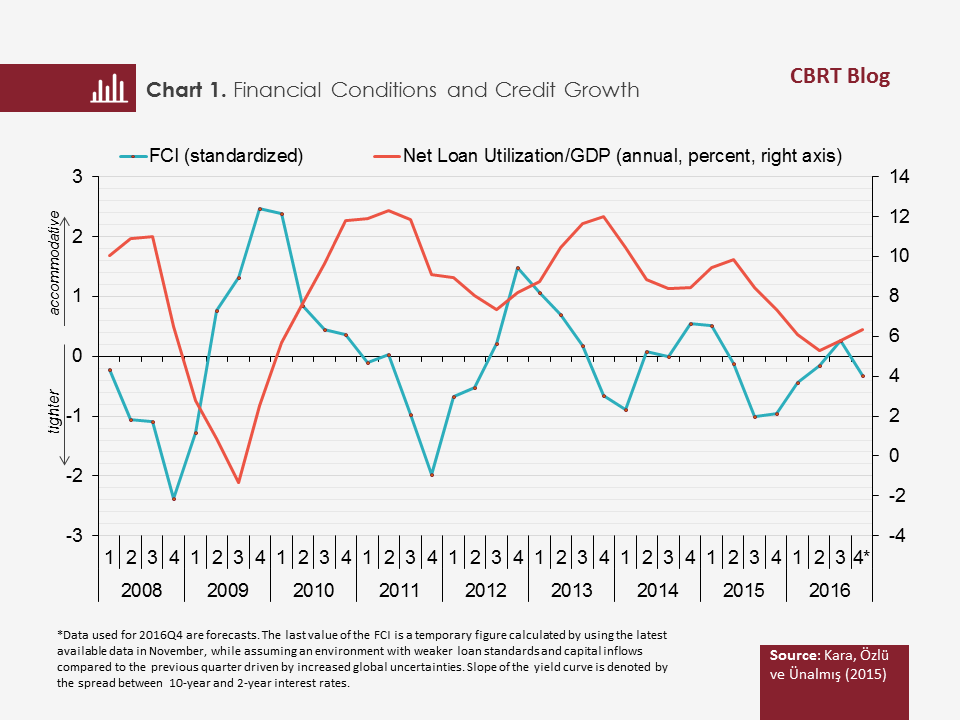

With this motivation in mind, an FCI for Turkey was developed in a study by Kara, Özlü and Ünalmış (2015). The CBRT regularly updates and publishes the FCI in the quarterly inflation reports, where the FCI is assessed as a leading indicator for credit growth (Chart 1). The statistical analyses on the forecast performance of the FCI indicate that the financial conditions index is an important leading indicator for credit growth, where the index precedes the loan growth with an approximately three quarter lag.

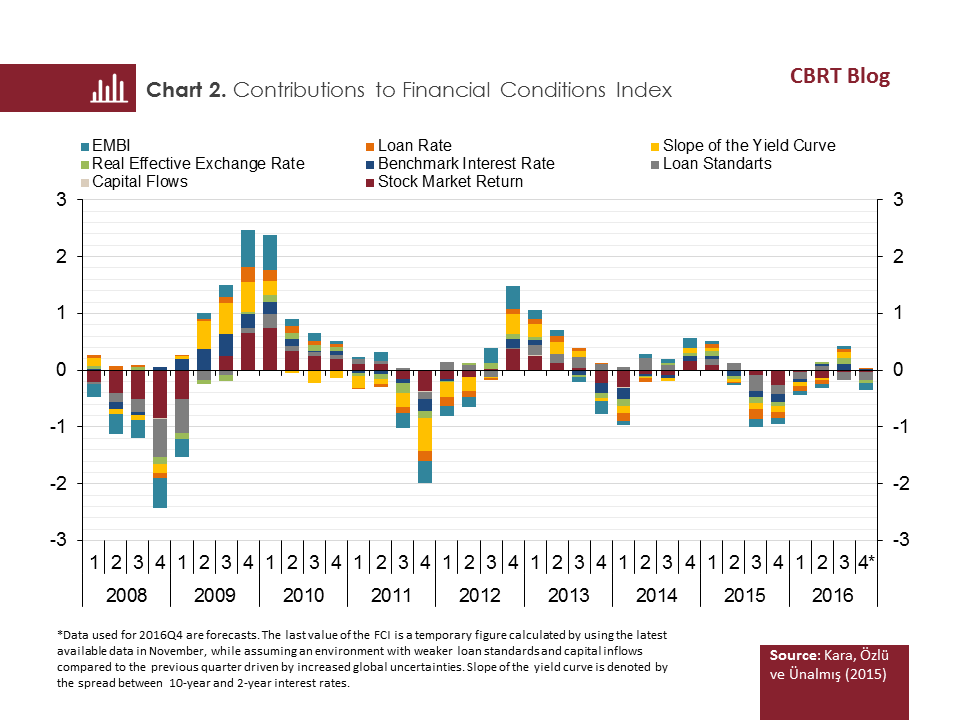

Chart 2 shows the evolution of financial conditions over time and the contribution of each variable that is included in the index. Positive values indicate that financial conditions are accommodative while negative values point to tight financial conditions. The movement of the index reflects the direction of the change in financial conditions. The contribution of each variable contains information on the financial indicators that are influential on the movement of the financial conditions. At times of extreme loosening or over-tightening in financial conditions, identifying the variables in driving these abnormalities can help to evaluate the appropriate policy response. For example, in the third quarter of 2016, the tightness in financial conditions was mainly driven by credit standards while other conditions were mostly accommodative. According to the currently available data on the fourth quarter of 2016, other variables, particularly the risk premium and the exchange rate, have also started to make a negative contribution to the index. The index and the sub-component contributions contain useful information for understanding the impacts of the financial cycles and the policies implemented.

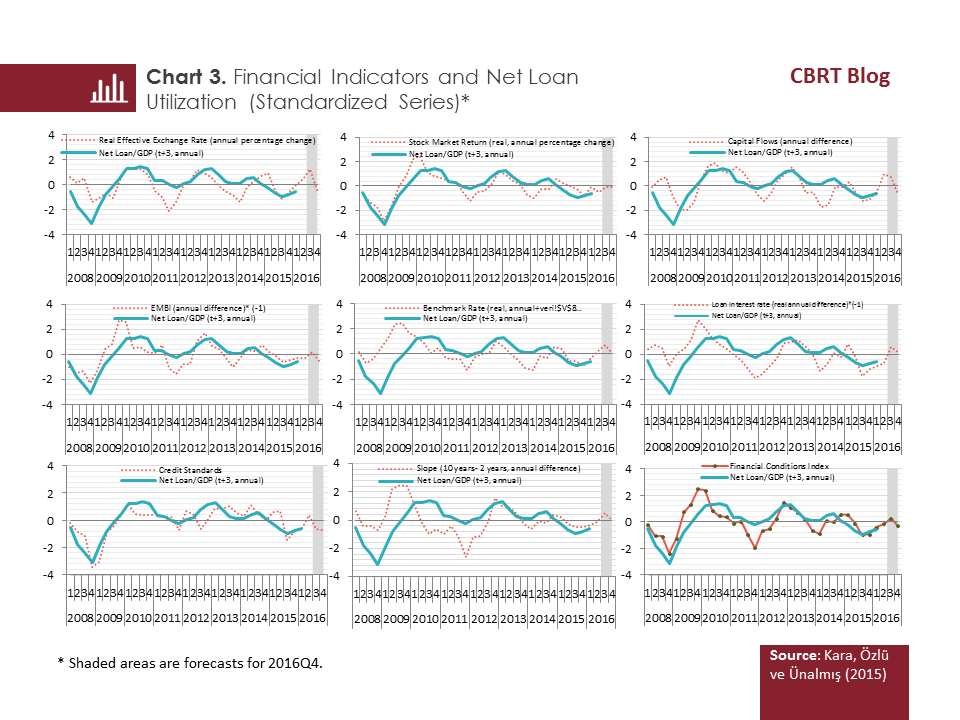

In Chart 3, the variables in the index, whose signs are corrected with respect to their contribution to the index, are compared with the net credit utilization (change in credit stock) in share of GDP. Similar to the index, the financial indicators generally lead the net loan utilization by three quarters. According to the latest data for the fourth quarter of 2016, many variables that contribute to the index have moved towards the tightening side due to the elevated global uncertainties driven by the presidential elections in the USA. The interest rates on loans, however, have remained at a slightly more accommodative level compared to the previous periods owing to the cuts in CBRT lending rates between March-September 2016. Overall, the FCI have moved to a tighter territory in the last quarter.

To conclude, financial conditions is a useful concept that complements the conventional interest rate policy while making monetary policy decisions. Particularly, in periods of weaker relationship between monetary policy rates and other financial indicators, monitoring the FCI becomes more important to concurrently assess the overall financial conditions.

Bibliography:

Kara, H., P. Özlü and D. Ünalmış (2015) "Türkiye için Finansal Koşullar Endeksi" (Financial Conditions Index for Turkey- available in Turkish only) Central Bank Review, 15(3), 41-73.