FX borrowings by the corporate sector increased after the global financial crisis. Therefore, the sensitivity of non-financial corporations in emerging market economies (EMEs) to exchange rate developments increased, becoming a risk factor for financial stability. Depreciation of EME currencies prompted countries to take macroprudential policy measures that limit FX borrowings and encourage hedging through FX derivatives to safeguard financial stability1. The heterogeneity of firms’ use of derivatives is an important factor to be considered while designing policies to deepen derivatives markets and to expand risk management practices.

The study conducted by Akay, Küçüksaraç and Yılmaz (2019) examines the above-mentioned issues by using the financial statements of 177 firms quoted on Borsa İstanbul (BIST) Equity Market for the period of 2007-20172. While the net on-balance sheet FX short position of the sample firms was USD 15.5 billion in 2007, the beginning of the sample, this figure increased to USD 33.8 billion in 2017 (Chart 1). Despite the flat course in FX assets, the surge in FX liabilities as a reflection of the increasing FX indebtedness became determinant in the trend of the FX short position.

Looking at the off-balance sheet formations, firms across the sample exhibit FX long positions (Charts 2 and 3). Rising awareness of the implications of FX risks, enlarging liquidity of derivative instruments and lower cost of risk management activities are considered leading factors in the increasing use of derivative products by firms. As a matter of fact, out of the 177 firms examined, 17 were using derivatives in 2007 while by 2017, 41 were doing so (Chart 4).

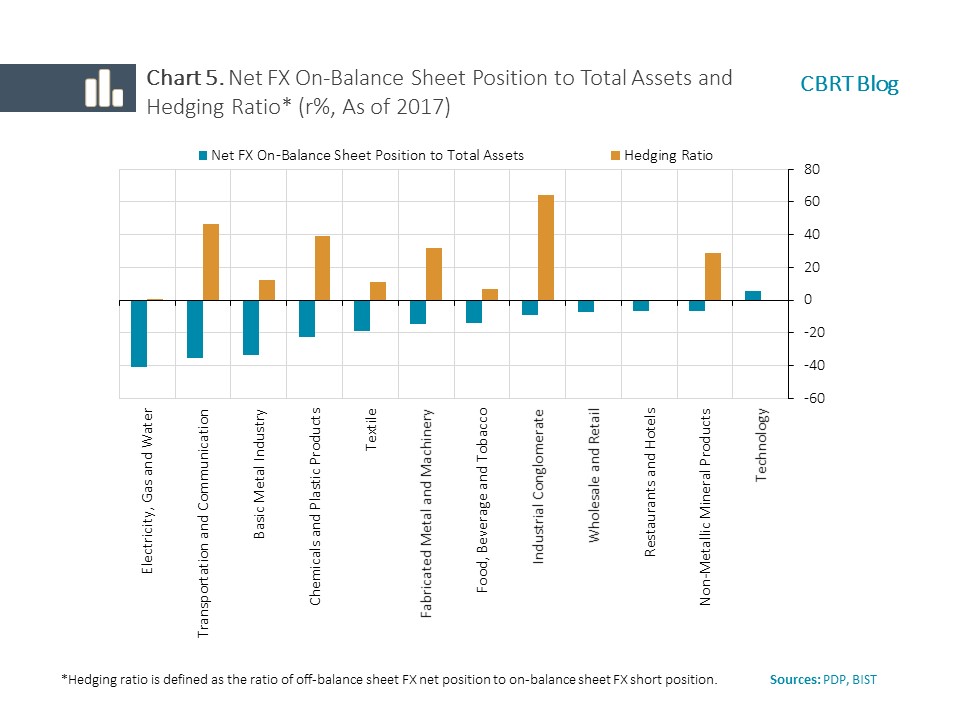

When the on-balance sheet net FX short positions of BIST-traded firms are normalized with total assets, firms belonging to sectors such as energy, transportation and basic metal industry seem to contain substantial FX short positions (Chart 5).

Which factors determine firms’ derivatives use?

Heterogeneity across firms and sectors increases the importance of factors that affect the propensity of BIST firms to use derivatives. Accordingly, the corporate finance literature suggests that characteristics and financial structure of firms may have an impact on their hedging behavior. Derivatives markets display scale economies in terms of cost. Besides, relatively large firms can hedge against risks more cheaply and from a wider range of products. This suggests there is a positive relationship between firm size and use of derivatives (Bodnar et al., 1998; Wang and Fan, 2011). On the other hand, the likelihood of experiencing financial stress and associated costs are known to propagate the use of derivatives (Glaum, 2002; Raposo, 1999). In the literature, these factors are measured by indicators such as firm size, leverage ratio and the ratio of tangible assets to total assets.

Additionally, reduced volatility in cash flows thanks to hedging practices makes firms more apt to take optimal investment decisions (Froot et al., 1993; Bessembinder, 1991). According to Aretz and Bartram (2010), the problem of underinvestment is more common among firms with higher growth opportunities. In this context, firms with relatively higher growth potentials are expected to have stronger motives to use derivative products. Again, the corporate finance literature indicates that hedging alternatives are also important determinants. Among these factors are liquidity buffers and dividend ratio (Triki, 2005). Finally, the exchange rate exposure due to operations is also argued as one of the factors that affect corporate hedging practices (Geczy et al., 1997; Allayannis and Ofek, 2001; Howton and Perfect, 1998).

We measured the effects of the above-mentioned factors for BIST firms by using the probit and fixed effects panel regression models. Detailed results are given in Akay, Küçüksaraç and Yılmaz (2019) study. Regarding the non-financial firms on BIST, the larger the firm size, the stronger the inclination to use derivatives. Firms with ample liquidity buffers consider this situation an alternative to hedging operations and tend to use fewer derivatives. Moreover, both the ratio of tangible assets to total assets, and the potential of growth opportunities as opposed to what is proposed in the literature, display a negative relation with use of derivatives. Meanwhile, firms with high leverage ratios tend to use derivatives more, which is consistent with the literature. The operational exposure of firms (high share of foreign sales) also supports use of derivative products.

In sum, the results of our study suggest that it will be beneficial to take into account the heterogeneity across firms in terms of off-balance sheet transactions while designing regulations to encourage them to hedge against risks.

[1] India and Indonesia are examples of countries that have engaged in such policy actions.

[2] To track the exchange rate risk, data on the currency structure of corporate balance sheets and positions taken in derivative products have been obtained from the disclosures of financial statements at the Public Disclosure Platform (PDP). Of the total BIST-quoted firms, 109 financial corporations are excluded from the study. Another 16 firms are also excluded as they have a different functional currency than Turkish lira. Additionally, to obtain a balanced panel structure, firms that do not have annual report for any year are also exempted from the sample.

References

Akay M., Küçüksaraç D., & M. H. Yılmaz (2019). The Determinants of FX Derivatives Use: Empirical Evidence from Turkish Non-Financial Firms in BIST. CBRT Research Notes in Economics 1908, Research and Monetary Policy Department, Central Bank of the Republic of Turkey.

Allayannis, G., & Ofek, E. (2001). Exchange rate exposure, hedging, and the use of foreign currency derivatives. Journal of International Money and Finance, 20(2), 273-296.

Aretz, K., & Bartram, S. M. (2010). Corporate hedging and shareholder value. Journal of Financial Research, 33(4), 317-371.

Bessembinder, H. (1991). Forward contracts and firm value: Investment incentive and contracting effects. Journal of Financial and Quantitative Analysis, 26(4), 519-532.

Bodnar, G. M., Hayt, G. S., & Marston, R. C. (1998). 1998 Wharton survey of financial risk management by US non-financial firms. Financial Management, 27(4), 70-91.

Froot, K. A., Scharfstein, D. S., & Stein, J. C. (1993). Risk management: Coordinating corporate investment and financing policies. the Journal of Finance, 48(5), 1629-1658.

Geczy, C., Minton, B. A., & Schrand, C. (1997). Why firms use currency derivatives. the Journal of Finance, 52(4), 1323-1354.

Glaum, M. (2002). The determinants of selective exchange risk management–evidence from German non‐financial corporations. Journal of Applied Corporate Finance, 14(4), 108-121.

Howton, S. D., & Perfect, S. B. (1998). Currency and interest-rate derivatives use in US firms. Financial Management, 27(4), 111-121.

Raposo, C. (1999). Corporate Hedging and Optimal Disclosure (No. 2000-FE-01).

Triki, T. (2005). Research on corporate hedging theories: A critical review of the evidence to date. HEC Montreal Risk Management Chair/Working Paper, 5, 4.

Wang, X., & Fan, L. (2011). The determinants of corporate hedging policies. International Journal of Business and Social Science, 2(6), 29-38.